Delivery

The Letwin Review believes so. But our research of new build sales rates suggests there are many other factors at play

.png)

The Letwin Review believes so. But our research of new build sales rates suggests there are many other factors at play

Housing continues to be a key political issue, as the government searches for ways to boost delivery by building 300,000 new homes per year in England.

In 2016, annual planning consents granted reached 300,000 and have continued to climb. However, despite rapid increases in output, the 217,000 net additional dwellings for the year to March 2017 leaves a big shortfall. Lead indicators, including energy performance certificates for new dwellings, suggest that the figure for the year to June 2018 will be slightly higher, but with lower growth than in previous years.

Sir Oliver Letwin MP has been investigating the causes of this gap, with particular focus on the buildout rates of large sites. After assessing 15 sites across England, his key conclusion was that build-out rates on very large sites are limited by the homogeneity of product. Major housebuilders should offer more variety in product type, tenure and design, which could result in more variation in pricing. This would make the new build market accessible to a greater number of people, thus increasing market capacity for open market sales and absorption via other tenures.

Variety of product will help with market absorption, but we also identify the roles of competition and pricing, alongside a greater variation of tenures

Savills Research

How important is product diversity?

We have tested Sir Oliver’s conclusion against our own data of 30 sites across the country, each with capacity for more than 1,000 homes. We assessed sales rates against the mix of house types (detached, semi-detached and terraced and flats) on each site. While there is a correlation between more diversified sites and a higher sales rate, this is an inconsistent relationship. Our analysis shows that there are many other factors in play.

The sites achieving the highest sales rates of at least 50 homes per quarter all provide a wide range of house types. At the Western Expansion Area in Milton Keynes, which had the highest sales rate of the sites in our study, the most prevalent house type accounted for 36% of units sold. The least prevalent type accounted for 18%. The sites achieving lower sales rates tend to have one product type dominating delivery, accounting for more than 50% of all sales.

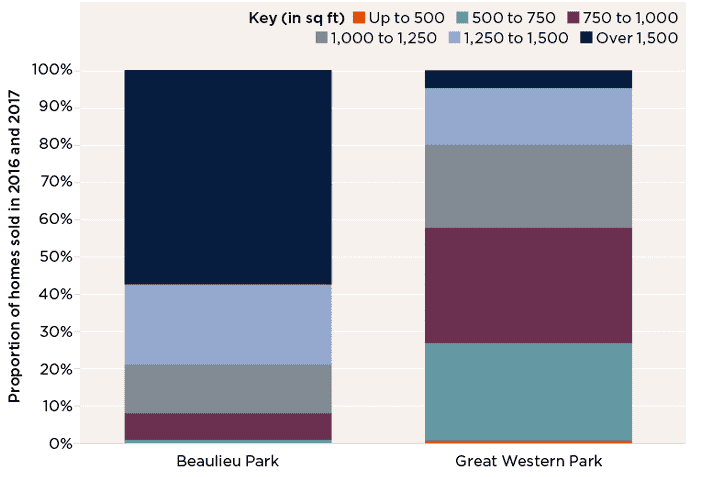

The effect of product diversity can be seen in the difference in build-out rate between Great Western Park in Didcot and Beaulieu Park in Chelmsford. These sites are of similar size, with capacity for 3,300 and 3,600 homes respectively, yet private sales have averaged at least 195 per year at Great Western Park (between Q1 2015 and Q4 2017) compared with 120 homes per year at Beaulieu Park (between Q3 2016 and Q3 2017). At Great Western Park, a wide mix of house types and sizes have been delivered, whereas the focus at Beaulieu Park has been on larger homes.

Tale of two sites At Great Western Park (sales rate 195 homes per year), a wide mix of sizes and homes have been delivered, whereas the focus at Beaulieu Park (sales rate 120 homes per year) has been on larger homes

Size distribution of new homes sold in 2016 and 2017

Source: Savills Research using HM Land Registry and MHCLG

.png)

Distribution of type of new homes sold in 2016 and 2017

Source: HM Land Registry

The importance of competition

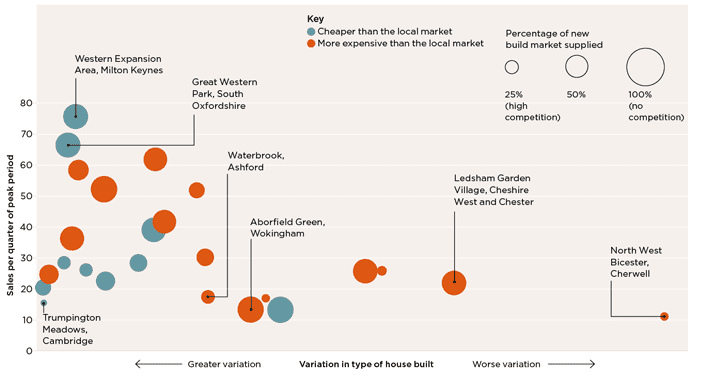

However, a variety of home types doesn’t guarantee a high sales rate. The sites in our study that had the highest variation in product all had peak sales of fewer than 30 homes per quarter, less than half the rate of the fastest-selling sites. Clearly, building less homogenous developments isn’t the sole solution to the challenge of increasing delivery.

Instead, our analysis shows that the broader market context for each site is the main influence on sales rate. Competition among sites is a key limiting factor on the pace of sales. All of the sites that achieved a sales rate of more than 30 units per quarter were supplying over 50% of new build homes within a two-mile radius of the site. The correlation between sales rates and share of the local new build market is more than 2.5 times stronger than that between sales rates and product variation.

Pricing relative to the local market is also a factor on sales rates. Where large sites are successfully selling high numbers of new homes, particularly in less affordable areas, the homes tend to be priced in line with or below the local market.

Great Western Park and the Western Expansion Area in Milton Keynes have average sales values 2% below the average for the local new build market. North West Bicester, Ledsham and Ashford, however, were selling at between 2 and 12% above the local market averages, and achieving much lower sales rates. To maximise absorption, new homes need to be accessible to the mass market. In unaffordable locations with competing supply, this requires new homes to be priced below local market averages.

Beyond sales rates

Looking at sales rates should not be the only focus for boosting housebuilding. There were 1.2 million residential transactions in the year to June 2018, half a million few than before the global financial crisis. New build transactions have historically tended to follow overall market activity, amounting to around 10% of all residential transactions. In recent years, new build has climbed to 12% of all transactions, largely thanks to Help to Buy, but it is questionable how much further that relationship can be pushed, even with increased product diversity.

Therefore, if overall numbers of transactions do not increase, it is hard to see how new build sales will. Instead, developers need to tap into demand in other parts of the housing market. This will require more diversity of tenure, namely private rented homes and affordable housing, both of which are underserved by new housing development.

Factors affecting sales rates Product diversity, pricing and competing supply in the local market against sales rate per site

Source: Savills Research

Price

Where large sites with significant competing supply are selling high numbers of new homes, they tend to be priced in line with, or below, the local market. Our research revealed lower sales rates where properties were sold at margins that were as little as 2% above the local market average.

Local competition

The correlation between sales rates and share of the local new build market is more than 2.5 times stronger than that between sales rates and product variation. Our research of 30 sites across the UK showed that those with a sales rate of more than 30 units per quarter were supplying the majority of new build homes within a two-mile radius of the site.

2 other article(s) in this publication