The economic, social and environmental contribution of our global forests is increasingly important. The demand for timber and processed wood products underpins trade in global timber markets. Economic growth, exchange rates, policy, technological advances in processing and the growing global interest in promoting the benefits of using wood all have an influence on demand.

A closer look at the global perspective supports a positive outlook for European and indeed UK forestry and wood products. The UNECE (United Nations Economic Commission for Europe) and FAO (Food and Agricultural Organisation of the United Nations) are forecasting increased wood consumption in the ECE (Economic Commission for Europe) region during 2018.

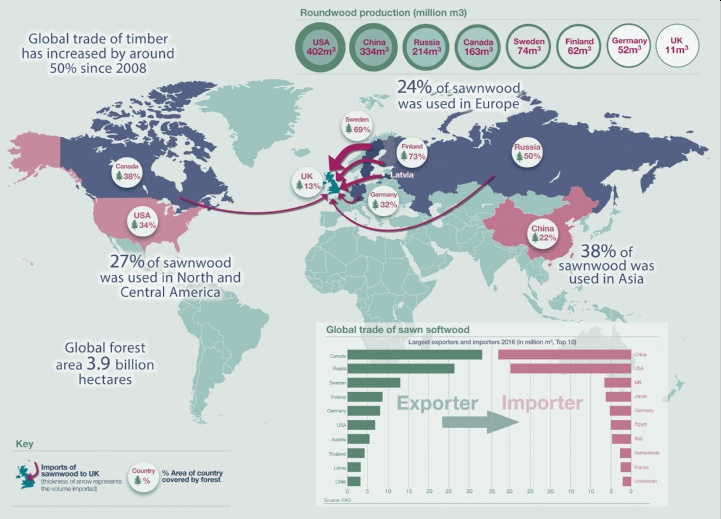

However, the UK is one of the least densely forested countries in Europe with around 13% forest cover (Figure 8). This compares with 38% for the EU as a whole and 31% worldwide. In contrast, the UK also has less than 1% of the global population but is the third largest importer of sawn softwood and in 2016 imported over 5% of the globally traded volume. The UK was the largest global consumer of wood pellets in 2016 with 26% of global consumption compared to America at 22% and Germany at 3%.

.png)

.png)