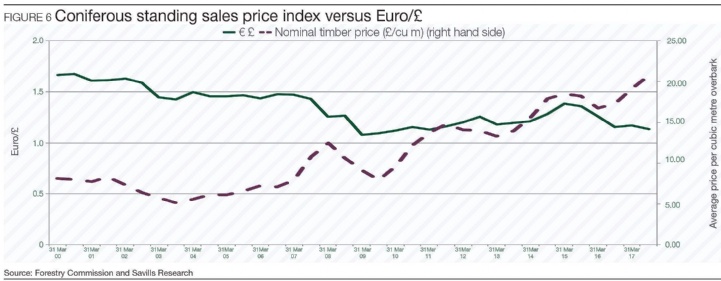

The Forestry Commission Standing Sale Price Indices, September 2017 shows sharp upwards movement since September 2016 reflecting exceptionally strong demand for both sawlogs and industrial roundwood.

The timber processors have had to deal with a combination of factors influencing their markets. At the beginning of 2017 sawlog demand increased to sustain higher levels of sawmill production and prices increased steadily as competition for supplies intensified. End user demand was not constant across all product categories and conversely, the availability of industrial roundwood increased during the first half of 2017 and prices were subdued.

By the summer, supply and demand were more balanced and industrial roundwood prices stabilised. Throughout the final quarter demand and prices increased because of additional processing capacity and a reduction in availability of wood chips and sawdust as sawmill production levels dropped in reaction to the lack of sustainably priced sawlogs.

Prices have continued to increase and when the Forestry Commission publishes the Standing Sale Price Indices to March 2018 it is expected to show a further price escalation. The current market conditions are expected to remain unchanged throughout the first half of 2018.

.png)

.png)

.png)