Despite general uncertainty in the property world surrounding the potential effects of Brexit, the UK forestry market continues to demonstrate a degree of resilience and posted another year of strong performance. Underpinning the forestry market, domestic timber, supported by a weaker sterling and the increasing demand for wood in biomass and construction, continues to drive value in the forest property sector.

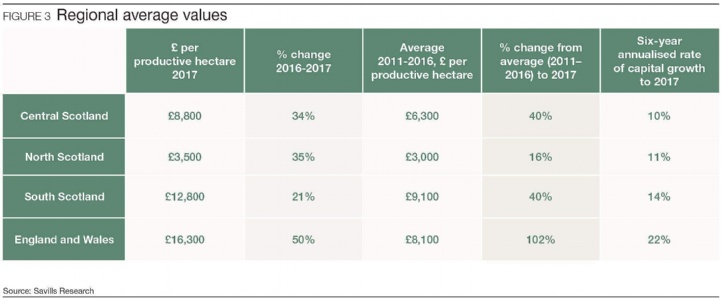

Average forestry values are diverse and factors such as location, access, tree species, average age and timber volume/quality all have an influence on the price paid which varies across the regions.

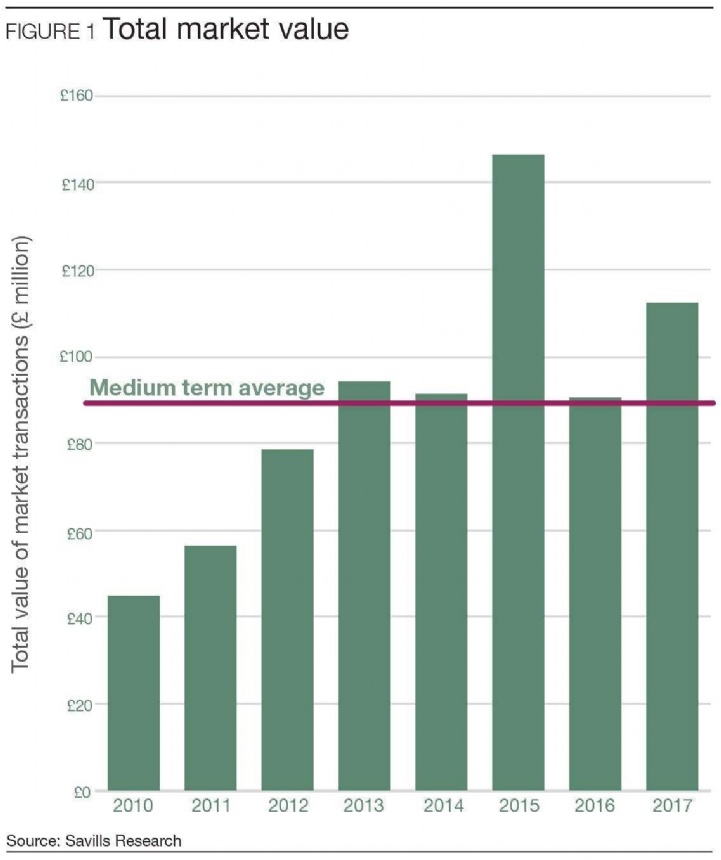

During the 2017 forest year the total value of the forestry investment market increased by 24% to over £112 million compared with around £90 million in 2016. Although this is significantly lower than the £146 million in 2015, the value of forestry transacted during 2017 is still 25% higher than the medium term average (Figure 1).

.png)

.png)

.png)