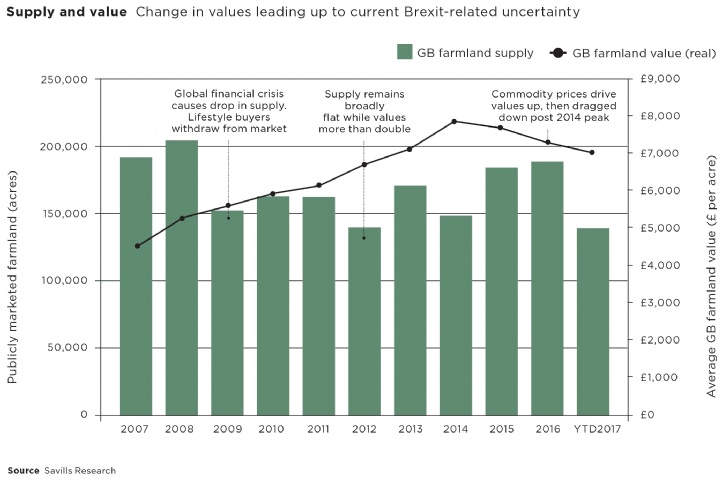

N ear-term, we believe UK farmland transactions will remain subdued as existing and would-be commercial operators delay entering the market until more is known about farming’s future prosperity. Supply volumes are unlikely to reach the long-run average and the bid to guide price spread depending upon location and quality. Declines in average values are not forecast to go beyond a -5% annual dip.

Into the medium-term, the implications of not agreeing a Brexit deal and moving on to WTO rules and a reduction in agricultural subsidy could erode farm earnings, particularly for bottom-quartile operators. While existing subsidy levels are initially guaranteed by the UK Government, we have little clarity on either the amount of support or the distribution mechanism that will be adopted post 2020. Early indications do, however suggest a shift away from area-based basic payments with the bulk of funding allocated to environmental objectives with natural capital becoming a main priority for agricultural policy. Many operators will have to work hard to adjust to the new environmentally linked income streams, although the pace of transition is likely to be manageable.

The impact of different trade arrangements and a reduction in agricultural subsidy will vary across the sector as scale, efficiency and income diversity will all play a role in the future success of a business.

Our scenario-modelling suggests the livestock sector (beef and sheep) is particularly vulnerable. Any increase in borrowing costs will exacerbate the situation for businesses operating with high levels of debt. Where a shortfall in profitability cannot be balanced out by subsidy income, asset disposal may be the only option.

Longer-term, with greater clarity on our trading position and the structure of subsidy, the outlook is encouraging, as certainty will engender recovery and opportunity. Renewed confidence in the sector will encourage a recovery in trading volumes post 2019 and a return to consistent capital growth across all sectors. Less profitable businesses should find new ways to operate, albeit under new configurations.

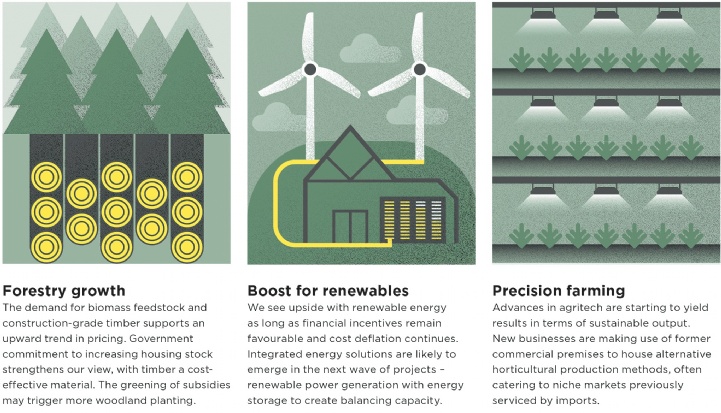

In addition, we see upside from energy and forestry where there is potential to realise short- to medium-term gains in asset performance. The attractiveness of farmland as a safe haven for wealth preservation, as an amenity asset and a long-term strategic investment will remain, particularly in times of heightened volatility.

.png)

.png)