Since the late 1990s, the residential investment market has been almost entirely associated with the buy-to-let investor. Rightly or wrongly, the ills of the UK housing market – most notably the difficulties faced by first-time buyers – have been laid at their door.

The summer budget of 2015 marked the point at which politicians sought to discourage buy-to-let investment through tax policy. And the squeeze continues as mortgage regulation spreads across both small-scale and portfolio landlords. Interest rate rises and progressive cuts in tax relief will limit investor opportunity.

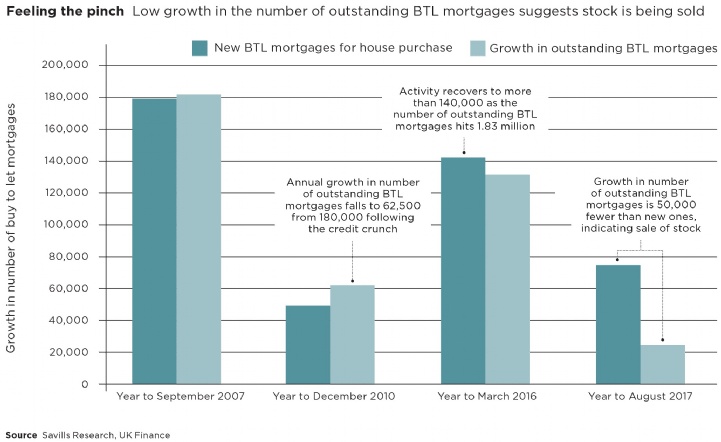

According to UK Finance, the number of buy-to-let mortgages granted for purchasing a property was 75,300 in the year to the end of August 2017 – 47% lower than in the year to March 2016. The growth in the number of outstanding buy-to-let mortgages is lower still, at just 24,800, and there is evidence that some investors are shedding stock as shown in the graph below.

.png)

.png)