While 2017 was characterised by forecasters revising their numbers up rather than down, investor and occupier reaction to Brexit turned out to be more of a shrug than an exodus. With investment volumes and leasing activity in some locations likely to have hit record highs, is a more opportunistic investment strategy for 2018 likely to pay off?

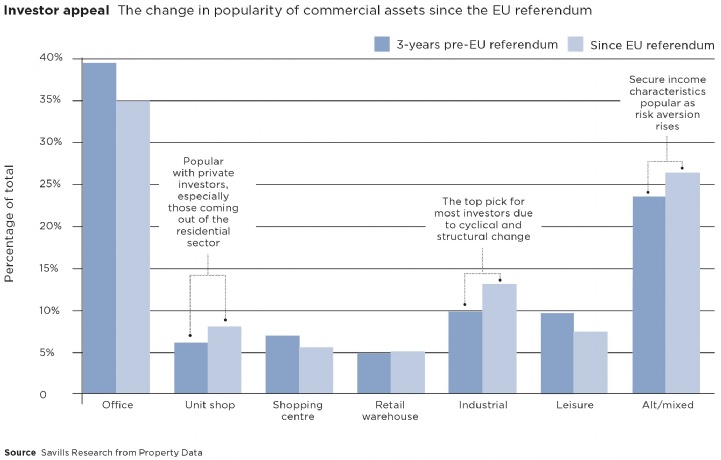

Domestically and globally, risk aversion among investors has risen, and we expect this to remain a major trend in 2018 and beyond. However, this does not mean people stop investing. It just affects what they invest in.

Any investment branded as core, prime, or secure will remain hotly sought-after, and the quirks of the UK commercial property lease mean that, in comparative terms, we will always look less risky than some other domains, regardless of local political issues such as Brexit.

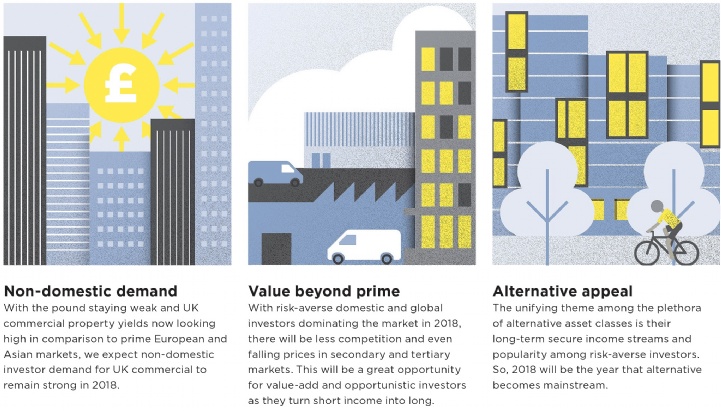

Non-domestic investors will be attracted to the UK by comparative risk, and also by comparative returns. Prime yields on many commercial property sectors in the UK are now higher than those in much of Europe and Asia-Pacific. We do not expect this story to change in 2018 and beyond.

Domestic investors are likely to remain cautious in 2018 because of home bias, and also as they tend to see local political issues as more important than they actually are.

The biggest beneficiary of the shortage of prime mainstream stock will be the plethora of income-producing assets classes that used to be lumped together as alternatives. Whether that asset is a pub or cinema, warehouse or student house, the attraction to investors will be the bond-type characteristics of the asset.

Of course, as an increasing number of investors herd towards a comparatively scarce pool of assets, an opportunistic window opens. Our core pick for high returns remains development or asset management across all subsectors of the commercial market – namely, turning short, risky income into long, secure income.

The other area of emerging opportunity also springs from herding biases. There are still sectors in the commercial property market where we believe that the received wisdom on that sector’s prospects is incorrect. Whether this applies to the impact of internet shopping on retail or Brexit on London offices, there are opportunities for investors to behave counter-cyclically.

.png)