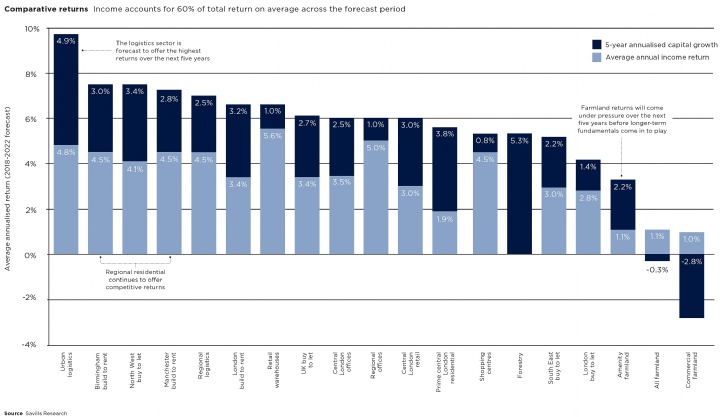

Five-year projected performance

At the top of our table sits the urban logistics sector, which delivers the highest income yield and strongest capital growth prospects. Secure income is popular, and pressure on land, particularly inside London from other uses, will maintain undersupply and deliver extra rental growth.

Not far behind sit the residential markets of the North West of England and the West Midlands, which retain the capacity for house price growth by reason of fewer affordability constraints. Corresponding higher-income yields should underpin performance in this part of the housing market cycle.

Pressure is on agricultural property – most at risk from the decision to leave the EU and uncertainty around future agricultural policy. Nonetheless, we expect holdings of scale with options to diversify income away from agricultural production to remain sought-after.

The mainstream London residential market also sits at the lower end of the table. This reflects relatively stretched affordability that leaves it exposed to fickle buyer sentiment and an affordability squeeze as the cost of debt rises. It sits in contrast to prime central London, where the market has already seen a double-digit price adjustment and, separately, the growing build to rent sector that is underpinned by the fundamentals of an undersupplied rental market in the capital.

Our key investment opportunities

Commercial

Urban logistics

Strong tenant demand and competition for sites from other uses will ensure strong rental growth. The strongest growth will be inside the M25, but we expect to see this spreading to big regional cities.

Affordable offices

With business uncertainty rising as we move closer to Brexit, we expect that clever property decisions will be popular with occupiers. The best locations will be accessible and affordable.

Residential

Multifamily in the regional cities

With the build to rent, or multifamily, sector gaining traction and expanding beyond London, large regional cities, such as Manchester and Birmingham, offer an opportunity to capture higher yields with good prospects for underlying capital growth.

Strategic land in the South East

Pressure to increase housing delivery and set objective targets for housing need at a local level are likely to open up opportunities to bring strategic land through the planning process. Areas without an up-to-date local plan, or an insufficient five-year land supply, offer the greatest potential supported by a range of measures to encourage house building set out in the recent budget.

Rural

Reducing risk through diversification

As the agricultural sector faces turbulence during the medium term, units with the potential to derive alternative income streams will remain attractive. Reducing exposure to a single enterprise will counter heightened volatility and price risk. We expect demand and capital values to remain resilient in this sector.

Growing returns from woodland

Strong demand fundamentals support our bullish outlook on forestry. Marginally productive agricultural land could offer an opportunistic purchase with value added by either expanding existing plantations or establishing new woodland. Current financial incentives would bolster cash flow within the first three to five years of the cycle, and longer-term prospects for capital uplift look positive.

.png)