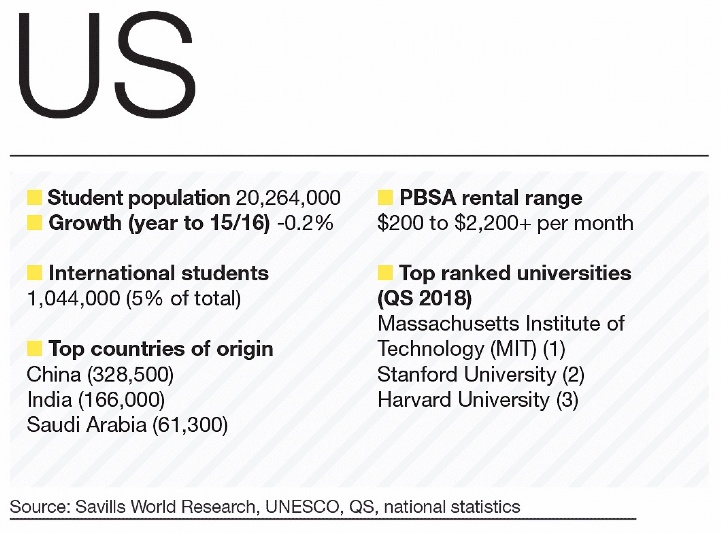

The United States has the third largest student population in the world behind China and India. Of the 20.3 million attending students college or university last year, 12.5 million were in full-time education. The US is the top destination for international students, hosting over a million in 2016.

Shared rooms are common in US PBSA, particularly among older stock. Most stock delivered by the private sector is as ensuite rooms in small cluster flats, usually located off campus. Private providers have pioneered premium, resort style properties offering swimming pools, barbecue areas, gyms and games facilities.

A large and mature market, the US attracts the lion’s share of PBSA investment. The two largest deals of 2016 were in the US (see 'New record levels of investment are being set'). Cross border activity rose to 39% of total US PBSA investment in 2017 to August.

.png)