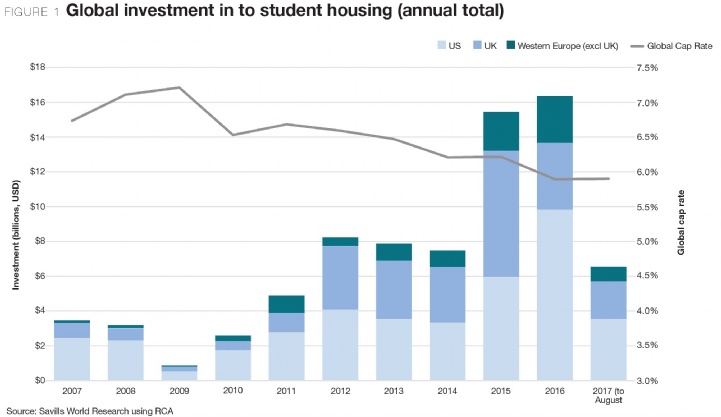

Global investment into student housing reached $16.4bn in 2016, setting another annual record. Total volumes by dollar value increased by 5.4% globally, double 2014 levels.

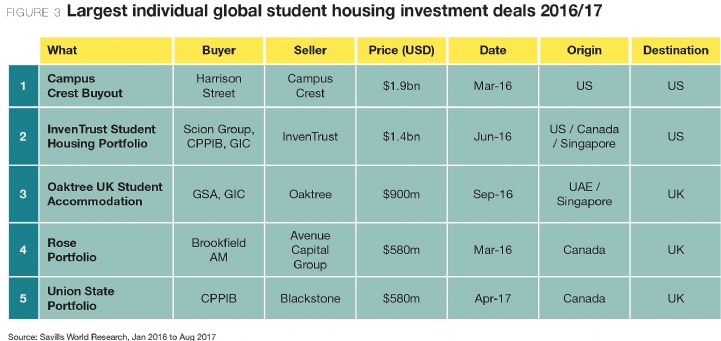

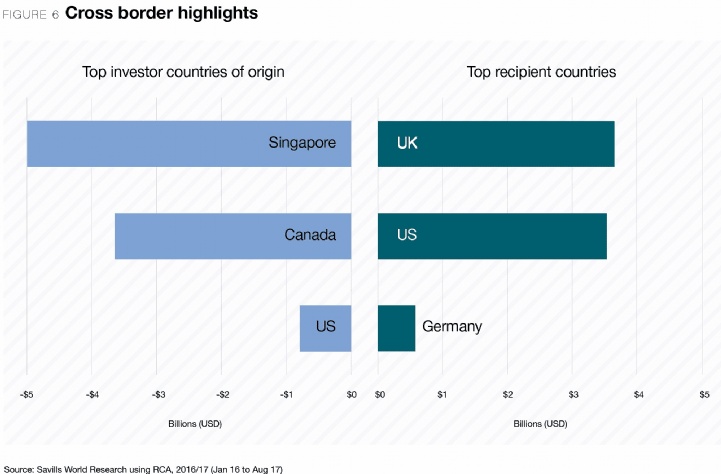

The US was the stand-out market in 2016 with $9.8bn total investment. Cross border activity accounted for 39% of total investment here, up from 21% in 2016, and just 1% in 2015. But the biggest deal was domestic: Harrison Street's buy-out of the Campus Crest REIT for a record $1.9bn. Second largest was the Scion Group’s purchase of the InvProperties University House portfolio for $1.4bn, in a venture with Canada’s CPP and Singapore’s GIC.

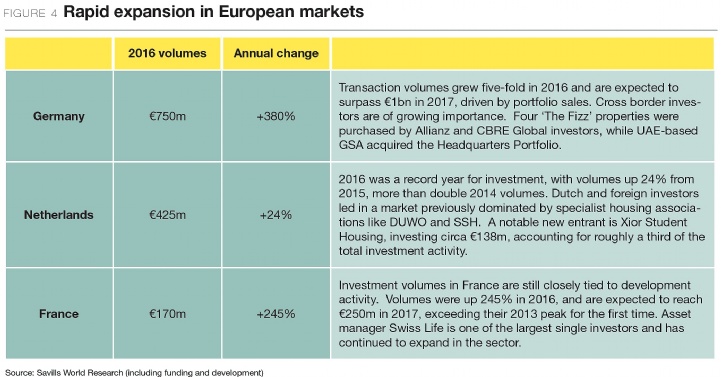

UK volumes fell back slightly from a high in 2015, a year that saw several large portfolios trade (most notably CPPIB’s purchase of the Liberty Living Portfolio for £1.1bn), but remained strong in the wake of the Brexit vote. Across the rest of Western Europe, investment volumes were up an average 26% in the year to Q2 2017. At a country level, Savills data showed volumes in Germany up 380% in 2016, and up 245% in France (see Figure 4).

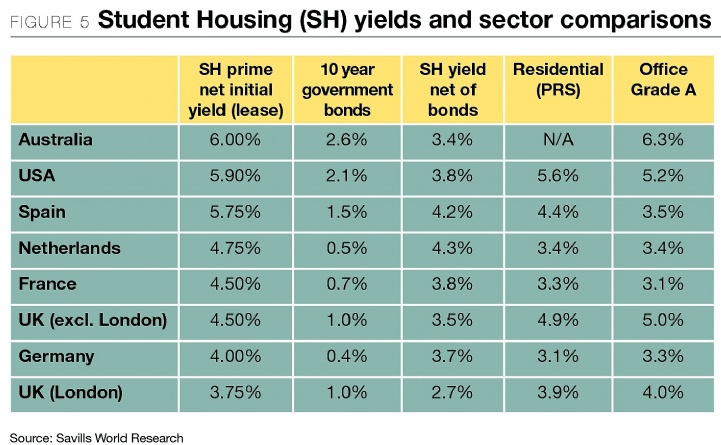

Student housing REITs have continued to perform well. Between January 2016 and August 2017, the major student housing REITs of the UK and US outperformed their all- REIT benchmarks by 10.6% and 4.4% respectively.

.jpg)

.png)