Downsizer

One feature of the current market is the emergence of the aspirational downsizer. These buyers have built up considerable equity as a result of rapid house price growth in Cambridge and South Cambridgeshire. Cambridge Insights are forecasting that the city’s population of over-65s will more than double by 2036.

Analysis of Savills transactions shows that over-60s accounted for 22% of secondhand sales between 2014 and 2016 and yet just 6% of new build sales in Cambridge. This suggests that there is an opportunity to target downsizers in the new build market – if the product, price point and, most importantly, the location is right.

These downsizers want to be close to the city, or to amenities, and are looking for a smaller, more manageable property which allows them to release equity from their home, but still provides spacious living areas and storage. However, there isn’t the provision of land within the city centre for such homes – meaning buyers are often looking to low-maintenance secondhand properties such as on the Accordia development, off Brooklands Avenue. Prices here have seen a steady increase over the last 12 months due to sustained demand from downsizers.

Family upsizer

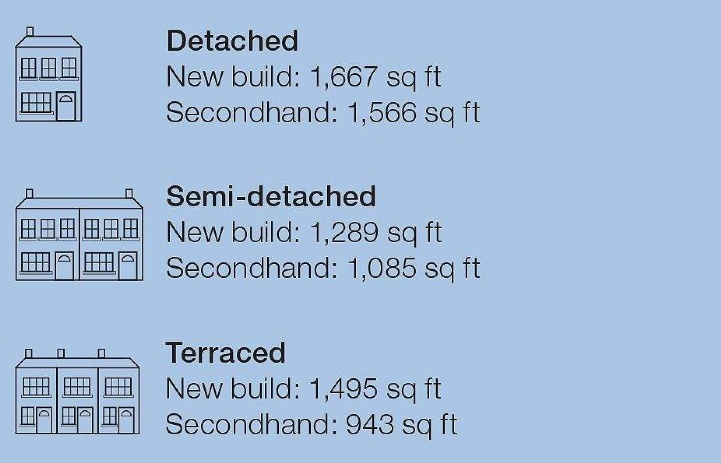

Cambridge is popular with families – 28% of Savills buyers were upsizing in the secondhand market between 2014 and 2016. Traditional family-sized housing stock in Cambridge is noticeably small; between 2012 and 2016, the average size of a secondhand terrace sold was 943 sq ft, while new build terraces have averaged 1,495 sq ft – close to the average size of detached secondhand at 1,566 sq ft. New build family homes are larger and have been weighted towards the upper end of the market.

There is a price gap in the new build market for upsizing families who are looking for more space. They are hitting up against the limits of mortgage regulation and a higher stamp duty bill, and need new homes on an affordable scale.

At the top end of the Cambridge secondhand market (in excess of £1 million), our prime index has shown values have softened by -1.7% over the last year.

Like aspirational downsizers, families are focusing on location, and properties close to the city centre and good schools are remaining popular. This is especially true if they have large gardens and space for multiple cars – features not commonly found in new build stock.

.jpg)

.jpg)

.jpg)