Cambridge continues to suffer from significant pressure on housing, and failure to address the problems could impact the market going forward. Ongoing affordability constraints are limiting the number of workers who can live in the city, pushing people out into surrounding areas and putting pressure on the already overstretched local infrastructure.

Affordability constraints

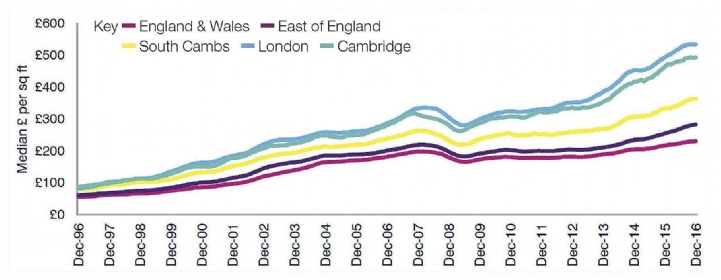

The city of Cambridge has seen rapid house price growth over the last five years of 55%. Growth in South Cambridgeshire has been slightly slower over the same period at 43%, but both have significantly outperformed the England and Wales average of 29%.

Median full time earnings within Cambridge in 2016 were £30,855 per annum, according to ONS. While this is higher than the UK average, the spending power of different residents varies massively. Employees in the professional, scientific and tech sector make up 16% of Cambridge’s total employment market, yet contribute more than 20% of the city’s total GVA. These industries are fuelling earnings at the top end, but annual pay in the lowest percentile is only £16,460.

In terms of value per square foot, Cambridge behaves much more like London than the rest of the East of England. Central Cambridge, at £630psf, is achieving equivalent values to Zone 2 locations in London, such as Brixton. With the average house price in the 12 months to May 2017 standing at £490,000, homes in Cambridge are currently 13.5 times more than earnings. This makes it one of the least affordable places in the country.

.jpg)

.jpg)

.jpg)