Talent pool pipeline

Occupiers are also concerned about where future pools of talent will come from. Education accounts for around 15% of Cambridge’s Gross Value Added (GVA), more than twice the UK average, which is largely driven by research and development at the University of Cambridge. However, Cambridge currently retains only 17% of its graduates in the city after graduation. London retains 77%. Cambridge must retain more of its homegrown talent in order to expand further.

One major challenge for the education sector is the UK’s relationship with the European Union. Typically, 10% of Cambridge’s undergraduates come from other EU countries, but the university recently revealed that 2016 applications from member states had fallen 14% on the previous year. The potential of higher fees for European students and uncertainties over post-Brexit R&D funding could pose a threat to the city’s growth.

In 2016, 13% of the University of Cambridge’s research grants were provided by EU funding. Although uncertainty surrounds the EU funding gap into UK universities post-Brexit, the UK will continue to benefit from Horizon 2020 funding.

So, unless Brexit causes an investment hiatus, the outlook for Cambridge remains positive, but short supply in the office and laboratory pipeline means there is a risk that some investment might be deflected elsewhere.

Boost in commercial investment

There has been a stepped increase in commercial investment volumes in Cambridge in recent years, with the five-year average reaching £241 million; 65% above the long-term annual average. Notable transactions have included Aviva Investors’ acquisition of 50 and 60 Station Road in the CB1 District for £80 million, and the purchase of 14-15 Market Street for £18 million by a private Saudi Arabian investor.

The UK Institutions have historically preferred prime assets in the city and are under increasing pressure to buy following strong inflows of capital.

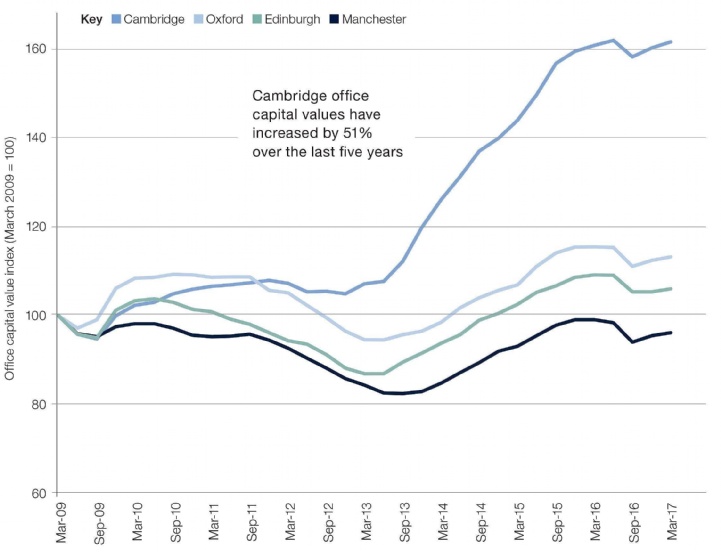

Strong investment levels have driven capital value growth; Cambridge’s office/laboratory capital values stand 62% above the March 2009 levels. Comparable UK cities have not seen the same growth. Values in Oxford, for example, have only grown by 13% in the same period, whilst Manchester’s office capital values have still not yet recovered to its 2009 values.

Strong international demand and the return of the UK institutions during 2017 has seen prime office yields fall from 5.25% to 5% over the past six months. This being said, yields remain attractive relative to the City of London and West End, at 4% and 3.25% respectively.

.jpg)

.jpg)

.jpg)

.jpg)