Cambridge’s ability to attract multinational office and lab occupiers in recent years has allowed it to compete with other global cities as a biosciences and pharmaceutical hub.

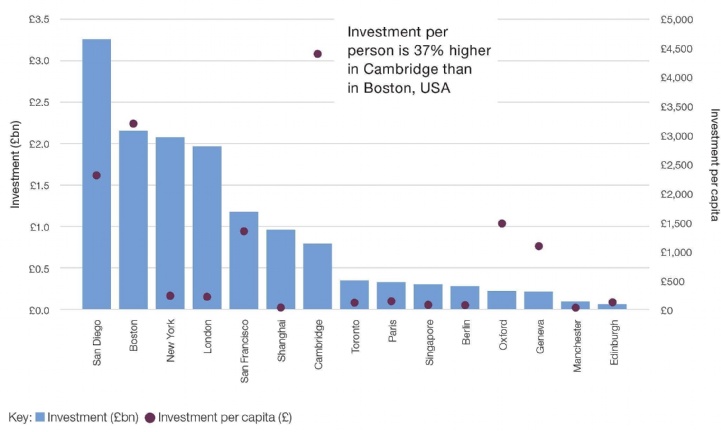

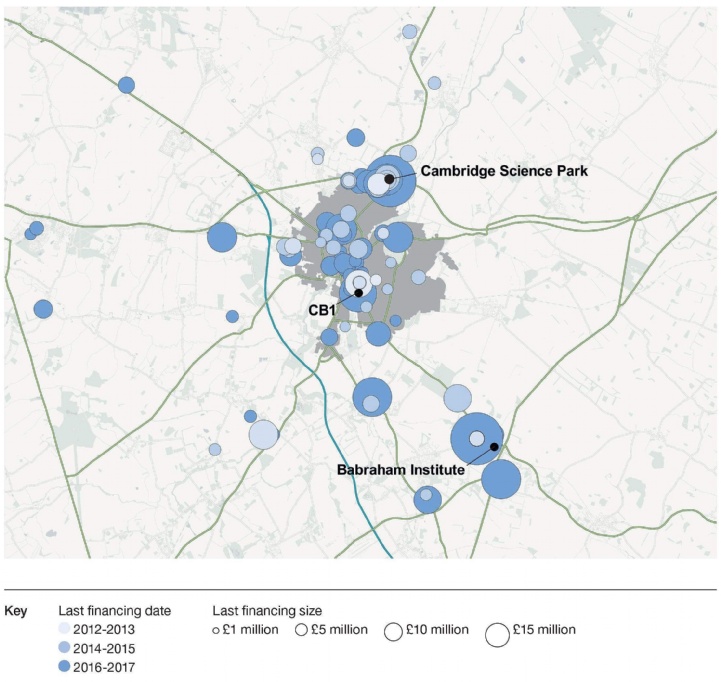

The flow of investment capital is a lead indicator of future commercial real estate growth. Venture capital (VC) investment, with its focus on the start-up community, is therefore a good indicator of future intentions. Since 2012, £790 million of VC funds has been invested in Cambridge. Of this, £270 million was in the first seven months of 2017.

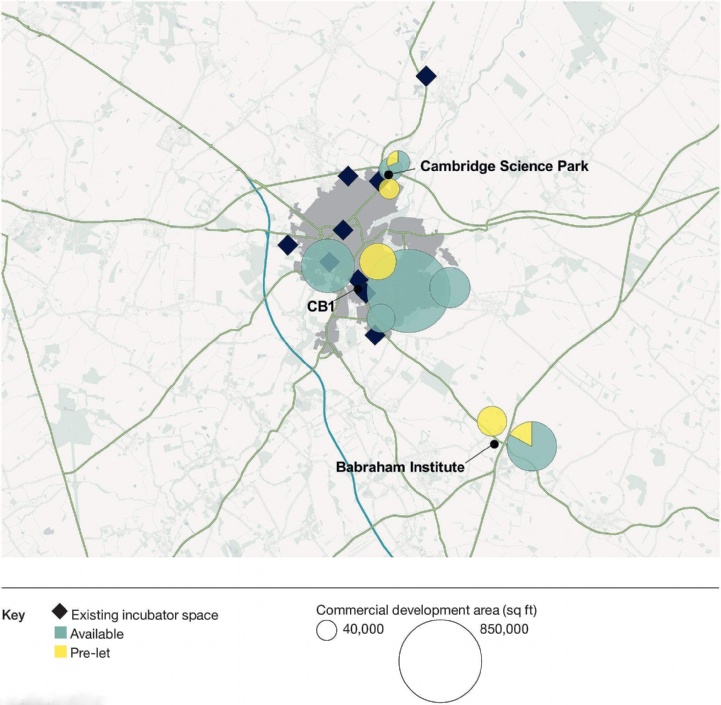

More than 84% of this funding has been invested in the pharmaceutical, biotechnology and software sectors. These have become the key sectors for Cambridge’s economy, and will require the further development of start-up, and grow-on, office and laboratory space. The strength of the Cambridge ecosystem reaches beyond the city boundaries. Recently, £40 million was invested in the cancer treatment firm Bicycle Therapeutics, who are based six miles from the city centre at Babraham.

Since 2012, Cambridge has received £4,415 of VC funding per capita – 37% more than its nearest global competitor, Boston, USA.

.jpg)

.jpg)

.jpg)