Text: Matthias Pink

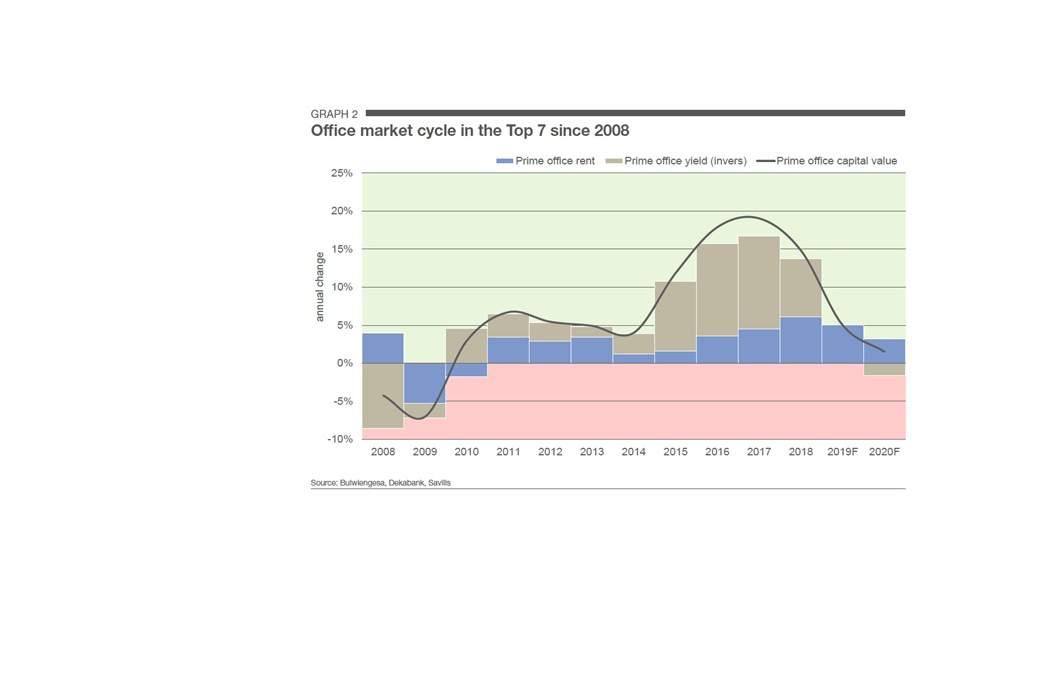

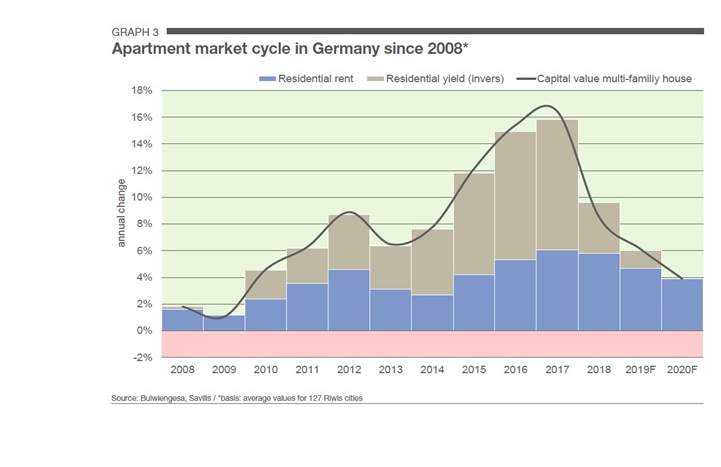

Today, ten years on from Lehman, players in the German real estate market are no longer staring into an abyss; they are enjoying the views from previously unscaled heights. The brief downturn associated with the financial crisis, which in terms of the apartment market was actually only a small dent, has been followed by an upturn spanning many years (Graphs 2 and 3) and the longest to date since German reunification. Since 2015, at the latest, the pace of rental growth and yield compression has been so great that the upturn can be confidently referred to as a boom. We are also almost certain that this boom is now coming to an end. However, that is not to say that the market is immediately about to go downhill. Rather, that the boom is set to revert to an upturn since the stimuli of monetary policy that created the boom are becoming weaker. The US Federal Reserve has now hiked its key interest rate eight times and has signalled its intent to continue on this path. The European Central Bank (ECB) has also begun to unwind its ultra-accommodative monetary policy albeit without hiking interest rates to date.

The normalisation of monetary policy will take much of the momentum out of the supercycle but will not bring it to an end. This is explained by the fact that, firstly, normalisation has long been factored into investors’ expectations and, as such, is already reflected in investment decisions and prices. Secondly, unlike the previous debt-driven cycle, the current cycle is driven by equity, which is why the braking effect imposed by interest rate increases via financing channels is likely to be relatively modest. In any case, the ECB appears to have limited room for manoeuvre in terms of interest rate hikes. The consensus estimate of analysts is that the key interest rate will remain below 2% up to and including 2023. The same applies to 10-year German government bonds. Hence, while the reversal in interest rate policy is not necessarily a threatening scenario, (the prospect of) more restrictive monetary policy will not pass by without consequence. We expect three consequences, which are as follows. Firstly, inflows of capital into the real estate markets will be reduced. Secondly, there will be no further yield compression driven by interest rates. This will culminate, thirdly, in initial yields only hardening further in those sectors and regional submarkets in which rental growth prospects are enhanced by strong fundamentals.

In the office markets, the continued economic growth is likely to produce rising demand for space. However, the outlook has recently become clouded and the list of actual and potential stress factors is long (trade conflicts, Brexit negotiations, EU budget dispute with Italy, etc.). The economic upswing remains intact but it is on shaky ground. At the same time, completions of office space in the top seven cities are on the rise again, particularly in Berlin. Even in the German capital, however, the expected new-build volume for 2019 is only sufficient to cover projected requirements and supply is only expected to grow somewhat faster than demand from 2020. We expect rents in the top seven cities as a whole to show similarly strong growth in 2019 to that witnessed in 2018 before the pace of growth subsequently slows (Graph 2). However, should the economy lose momentum quicker than expected, the period of rental growth could well come to an end sooner. In any event, we consider a reversal in the economy to be a far greater risk than a reversal in interest rate policy. Market participants are prepared for the latter but are probably not ready for a recession.

In the apartment market, only stringent regulation could prevent further rental growth (and even then, only ostensibly). Building permits for apartments continue to lag behind demand, not to mention completion figures. And since this appears extremely unlikely to change in view of the numerous shortages (including development sites and personnel in both planning authorities and construction companies), there is fundamentally only one realistic scenario. Rental growth on apartments is likely to continue to outstrip the inflation rate over the coming years (Graph 3).

.jpg)

.jpg)

.jpg)