A key and growing life science market in the US

The Southern California life sciences industry has been one of the most active for venture capital and specialised real estate demand in the US. Since Covid-19, billions of dollars have been raised by emerging biotechnology and pharmaceutical companies, with the majority being located in San Diego.

The region has proven its ability to seed startups which can develop into multi-billion dollar companies

Michael Soto, Research Director, Southern California Region

San Diego has long been seen by many industry watchers as an elite cluster for life sciences due to the region’s long association with world-renowned research institutions such as the University of California-San Diego, Salk Institute, and Scripps Institute, as well as the local know-how by academic research scientists on how to start their own companies in the private sector. While well-known biotech and pharmaceutical companies such as Genentech, Pfizer, and Eli Lilly have long had a presence in San Diego, newer home-grown companies such as Illumina, Fate Therapeutics and Ambrx have shown the region’s ability to seed start-ups which can develop into multi-billion dollar companies. As a result, the traditional life sciences submarkets of San Diego such as University Towne Center (UTC), Torrey Pines, and La Jolla have seen hundreds of thousands of square feet of new life sciences real estate development and increasingly, conversions from general office to life sciences/R&D use.

Looking into 2021 and beyond, we expect no slowdown in life science real estate demand in San Diego

Michael Soto, Research Director, Southern California Region

More recently, this occupier demand has spilt over to neighbouring submarkets such as Sorrento Mesa as developers seek out functionally obsolete office and industrial buildings to convert to life sciences use. In addition, developers have even begun doing the same in Downtown San Diego hoping that new fully amenitised properties built for life sciences users can attract some of San Diego’s booming life science real estate demand to a more urban environment. Looking into 2021 and beyond, we expect no slowdown in life science real estate demand in San Diego while emerging clusters elsewhere in Southern California such as Irvine in Orange County, as well as Santa Monica, El Segundo, and the Conejo Valley in Los Angeles will be watched very closely as venture capital aggressively seeks out the next big thing in a booming sector.

View from the US

Reviewing the trends in capital raised, in terms of type of deals and the volume, presents a great indication of the type of companies that will grow in the future and the type of real estate required.

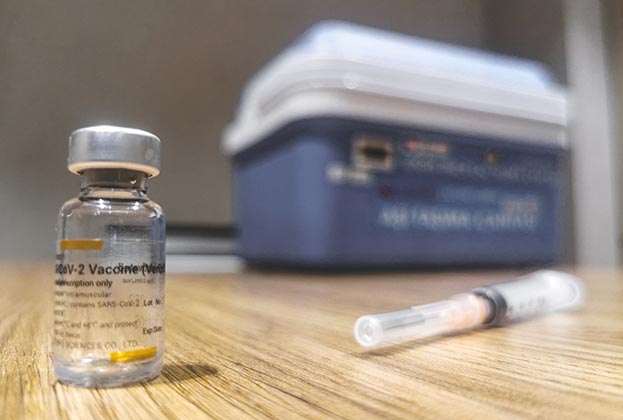

Four subsectors of life sciences accounted for two-thirds of all capital raised in the past five years. 'Drug Discovery' accounted for 29% of the total capital raised in this period (US$5 billion total). The other subsectors include, in order 'Biotechnology', 'Diagnostic Equipment' and 'Therapeutic Devices'.

The 'Drug Discovery' subsector saw a 40% share in 2020 with annual growth of 122%. Key deals include VelosBio being acquired by Merck for US$2.75 billion and Erasca raising US$236 million of Series B venture capital. Both companies are located north of San Diego, in the Torrey Pines area.

At nearly US$1 billion in 2020 alone, showing a 171% increase on 2019, the 'Diagnostic Equipment' sector saw a 16% share of the 2020 capital raising total. Cue Health received a US$481 million grant from the US Government to boost production to deliver six million Covid-19 tests by March 2021.

Read the articles within Spotlight: Life Sciences – Trends & Outlook below.

.jpg)

.jpg)