A positive outlook for the life science sector

The Australian life science sector is on an upward trajectory. There is significant interest from institutional funds and property developers looking to diversify their real estate portfolios.

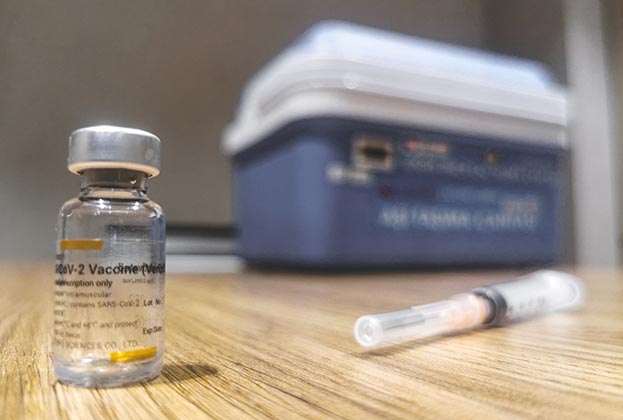

The growth of the sector and associated commercialisation is creating greater demand for bespoke research facilities. It has also been heightened by the Covid-19 pandemic which has accelerated public funding in this sector for both research and ancillary infrastructure.

The level of demand varies from city to city in Australia, however, tends to be concentrated on the eastern seaboard capital cities of Melbourne, Sydney and Brisbane. These cities provide the concentration of population and advanced skills capability to resource this rapidly emerging sector.

Australia's geographical positioning in the Asia-Pacific region provides good synergies for research and diversified clinical trials with its Asian neighbours

Lawson Katiza, Director, Property Consultancy, Brisbane, Australia

Australia’s geographical positioning in the Asia-Pacific region provides good synergies for research and diversified clinical trials with its Asian neighbours. Australia’s leading digital medical database is another catalyst for attracting research. Some recent life sciences market trends include:

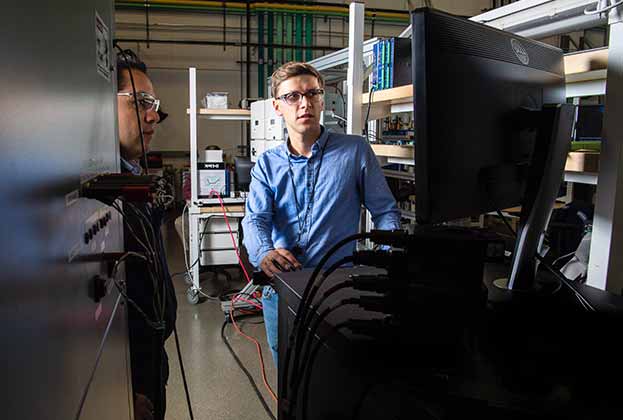

The Translational Research Institute (TRI)

The TRI is proposing an Australia first hybrid facility to complement its existing 34,000 sq m research facility (TRI2). The proposed TRI2 is a purpose-built scale-up and advanced manufacturing facility that will provide the means for start-up companies to move to the scale-up stage while also providing practical training in advanced manufacturing – an Australian first.

Vaxxas is one of TRI’s most successful start-ups. It has a focus on enhancing performance of existing and next-generation vaccines through development and commercialisation of the company's novel vaccine delivery technology - the Nanopatch™. Vaxxas is progressing into ‘Phase II’ small-scale manufacturing, which will require a pilot facility for pilot-scale manufacturing. This multi-million dollar facility at Hamilton Northshore is in procurement stage with funding from the Queensland State Government.

The combination of the TRI2, Hamilton Northshore plant and the progressing Boggo Rd Innovation Precinct will position Brisbane as a rapidly expanding and competitive innovation ecosystem that also provides bespoke national capabilities in areas such as practical cGMP training.

The Victorian Comprehensive Cancer Centre (VCCC)

Melbourne is home to Australia’s largest research facility and collaboration. The Victorian Comprehensive Cancer Centre (VCCC) is a AUS$1 billion (capital expenditure) world-class Comprehensive Cancer Centre. The VCCC is a powerful alliance of eight successful Victorian organisations committed to “prevention, detection and treatment of cancer.”

Most recently, what is reported to be the largest biotech and vaccine manufacturing plant in the southern hemisphere at 118,000 sq m has been proposed by CSL Group. Construction of the AUS$800m facility will commence in early 2021. The project is in collaboration with the Federal Government to “provide rapid response to future pandemics and provide the nation’s first mass-scale sovereign capability to defend against global health security threats.”

Private investment

We are seeing a trend with the larger property investment funds leading the charge in privately funded medical research facilities. Various ‘fundthrough’, ‘sale-and-leaseback’ and other hybrid financial models, they are emerging in particular with universities and large government research agencies that can provide strong covenants.

Innovation Quarter (iQ), Sydney | Source: Charter Hall

Charter Hall’s AUS $350million ‘Innovation Quarter’ precinct, colocated with Westmead Hospital in western Sydney – a collaboration with Western Sydney University is a good example of this (see image above). Across two towers and 28,000 sq m, the facility will provide health, research, education and commercial space, facilitating significant opportunities for collaboration across the public and private sectors.

The sector is helped in part by federal and state government funding which allows tenants to commit to long-term leases that provide investors with greater revenue stability and strong covenants

Lawson Katiza, Director, Property Consultancy, Brisbane, Australia

Research is very much a supply-led model due to the bespoke nature and intensive capital spend with a longer return rate. The sector is helped in part by federal and state government funding which allows tenants to commit to long-term leases that provide investors with greater revenue stability and strong covenants.

Read the articles within Spotlight: Life Sciences – Trends & Outlook below.

.jpg)

.jpg)

.jpg)