While new openings declined last year this was largely at the expense of smaller independent brands as the top three luxury houses, LVMH, Kering, Richemont all increased new store openings globally in 2018

As a result their collective share of new openings increased in 2018, accounting for almost a third. This expansion continued to be driven by core brands across each of the groups such as Louis Vuitton in the case of LVMH and Kering’s Gucci and Saint and Saint Laurent brands.

In the case of Kering, the expansion of its global footprint was also supported by openings by some its smaller brands such as Bottega Veneta, Maison Boucheron and Pomellato.

Stronger growth in luxury accessory spend is influencing store expansion

The entry point for many luxury consumers is the accessory segment. As a result it remained the largest and fastest growing personal luxury goods segment in 2018 according to Bain & Company reporting a 4% growth. Since 2010 annual growth has averaged 9%, the highest across the headline categories, led by shoes and jewellery.

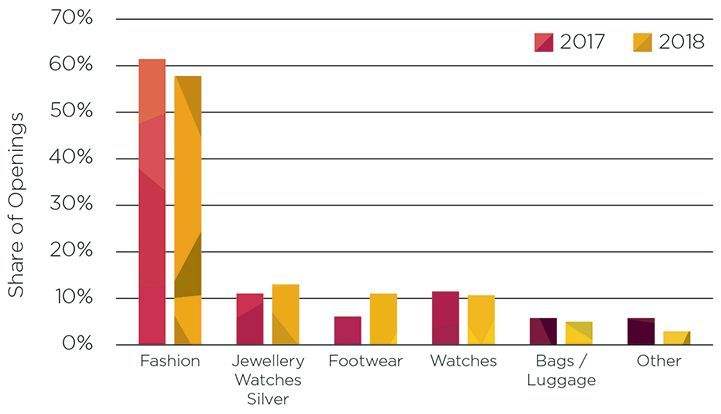

This trend is also being borne out in new store acquisitions. Specialist luxury footwear and jewellery brands increased global store openings by 54% and 2% respectively in 2018, with their respective share of total luxury store openings also increasing to 11% and 13%.

Share of New Store Openings, 2017 – 2018

Source: Savills Research | Note: excludes re-openings due to refurbishments, relocations and store-in-store openings. Includes airport and outlet stores.

Read the other articles within this publication below

.jpg)