Destination cities continue to prove attractive to expanding luxury brands with the focus on core strategic markets intensifying

Welcome to the Savills Global Luxury Retail 2019 Outlook.

This edition explores the recent trends that are occurring within the luxury retail market; identifying strategic cities that are seen as ‘core destinations’ for luxury brands, the rising importance of international flagship stores, the dominance of the big luxury groups, and what they are investing in to cater for the evolution in luxury spend driven by Millennial and Gen Z consumers.

Global luxury spend increased in 2018 albeit the number of new store openings declined. Despite this global decline what was apparent in those new stores luxury brands opened was the strength of strategic flagship stores in core luxury areas in global destination cities. This is supporting resilience and growth in headline asking rents across a number of ultra-prime luxury locations. The all-important Chinese consumer may be spending more domestically but the flagship store in destination cities will play an ever more important role in delivering a brand experience that will help drive sales whether they are at home or online.

The democratisation of luxury with the growth in online, preowned and rental luxury and streetwear will also shape the store experience and portfolio strategies of luxury brands as well as generate new types of luxury occupiers. This has already been seen with the growth in luxury spend in the footwear and accessory segments. This has driven increased activity from specialist brands in these segments driving demand for smaller units in and just off luxury pitches.

With our unrivalled knowledge of brand requirements and new entrants into the market, we are best placed to advise and provide in-depth insight into the key established and emerging markets. This is further bolstered through thought leadership and market intelligence from our specialist luxury retail research team. In recent years we have worked with a range of clients within the luxury retail sector and advised on a number of high profile transactions highlighted in this brochure. Our unique global offering positions us to simultaneously advise on locations, values and key property criteria throughout all major cities across the globe.

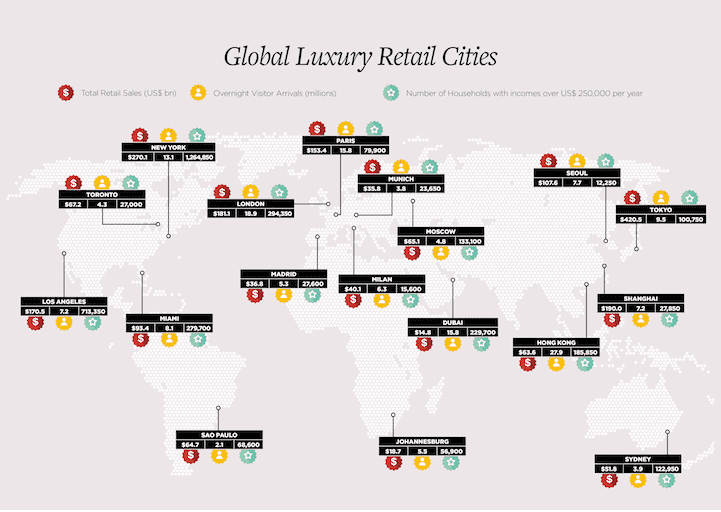

Source: Oxford Economics; Euromonitor; Local tourist offices (all data refers to 2018 apart from tourist numbers which refers to 2017). Household income data is based on Purchasing Power Parity in constant 2015 prices.

Read the articles within this publication below