The pattern of market share and values is broadly similar to recent years

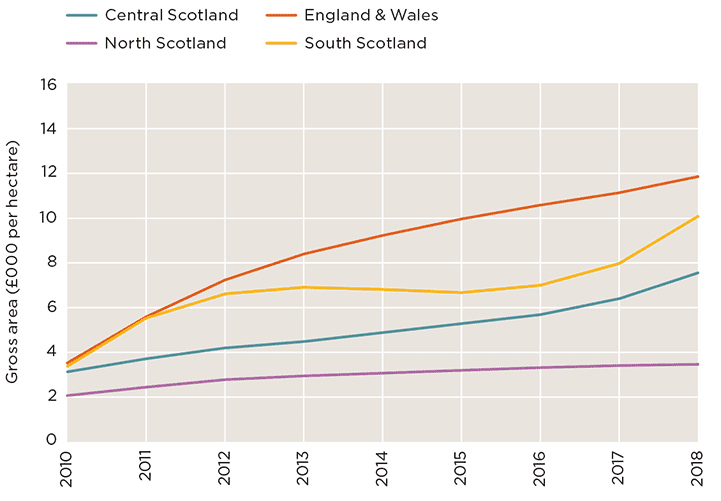

There is of course significant regional variation in average price and the trend shows increasing divergence as represented by the spread of lines on the graphs below. A number of different factors influence this. In England and Wales the small number of transactions is an important factor, meaning availability and subsequent competition is a key price driver. In north Scotland the relatively low and static pricing structure reflects the geography and productive capacity of the woodland resource, with large areas of low quality softwood, remote from timber markets and often challenging to harvest.

Regional Average Gross Values Polynominal £ per ha trend

Source: Savills Rural Research

.jpg)

Regional Average Net Values Polynominal £ per ha trend

Source: Savills Rural Research

The most interesting regions are south and central Scotland. South Scotland (extending into northern England) benefits from good growing conditions, good infrastructure and competitive timber markets. The market priced in these benefits several years ago with the three year rolling average reaching £9,000 per net hectare in 2014 and then staying within a relatively constant £1,500 per hectare of that figure since then, so within an overall movement of just 17%. Conversely, average values in central Scotland, which includes Perthshire, Argyll and Aberdeenshire, had a three year rolling average of only £6,400 per hectare in 2014, which has since increased to £8,870 per hectare, a movement of 38%.

While these changes are influenced by the individual properties sold, the strong price increases in central Scotland do directly reflect a noticeable change in investor sentiment that increasingly values woodlands in central Scotland supported by improving timber infrastructure and prices in remote areas. Mathematically, average values dropped slightly in England and Wales, but adjusting for the characteristics of the properties sold, values remain on an upward trend. In south Scotland, the average value over recent years rose sharply reflecting the high timber prices paid in this region. Within all regions, apart from north Scotland, the overall range of prices paid is widening, and increasingly reflects the productive potential of assets.

In terms of market share, the broad pattern was similar to recent years with over 90% of the market activity by area in Scotland. Market share by area was at the highest level recorded in south Scotland since 2015, and 72% of the overall marketed by area was in central and south Scotland, against a medium term average of 65% for these combined regions.

Read the other articles within this publication below

.jpg)

.jpg)

.jpg)