Solid consumer fundamentals continue, but Brexit uncertainty could drag on retail sales growth

The outlook for the UK economy remains undeniably weak, with the latest consensus forecast suggesting that GDP growth will average only 1.5% per annum over the next five years. The fact that this is in line with the projected growth for both France and Germany suggests that it perhaps has less to do with Brexit than a wider variety of factors that are slowing the global economy. However, slower GDP growth inevitably means weaker wage growth, with a corresponding drag on retail sales.

On the face of it however the British consumer should be feeling reasonably happy. Unemployment remains close to its lowest ever level at 4%, and consumer price inflation has eased downwards from its recent spike. This means that real earnings have grown by 1.1% over the 12 months to the end of December 2018, the fastest rate of growth since November 2016.

While consumer confidence has weakened in the early part of 2019, there is little sign in the official data that this is feeding through into slowing retail sales, and Christmas trading was generally up year-on-year both in terms of like-for-like and total sales.

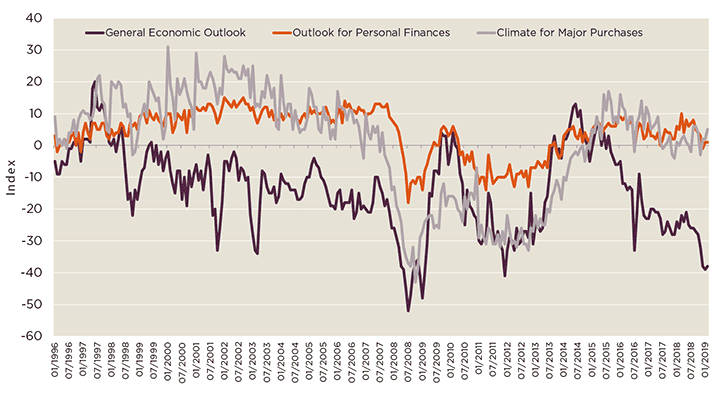

Consumer confidence has weakened in recent months, but people remain positive about their own financial future, and the environment for major purchases. The latter trend supports continued spending growth on bulky parks in particular

Source: GfK

Brexit uncertainty and consumer behaviour

With the Brexit clock at five minutes to midnight we have to indulge in some speculation about possible outcomes and what they might mean for consumer spending. Most opinion polls seem to indicate that when people are not questioned specifically on Brexit it is a minor concern. However, it is the question of a disorderly or hard Brexit that probably has the most significant implications for consumer sentiment and behaviour.

The biggest problem in assessing the impacts is that there is really no direct comparative event in the UK’s recent past. While the Global Financial Crisis was a very different situation for the UK consumer, the one similarity between that and a disorderly Brexit might be that both affect consumer sentiment fairly quickly.

In early 2008, the household savings ratio was at a fairly low level of just under 7%, but as the ripples of the GFC spread this quickly rose to 12%. While the direct effects of the GFC were fairly limited at that stage on the UK population, the unremittingly negative newsflow drove this sharp rise in precautionary saving. This in turn led to an almost immediate fall in retail sales growth, and then the swing into recession.

The last three years have been a period of very low savings ratios in the UK, primarily due to the equally low interest rates on offer to savers. Consumers have not just been spending the balance, some of what they previously might have saved has been used to pay down other types of debt. However, the lurking question around Brexit remains whether consumers would swing back into precautionary saving mode if uncertainty intensifies.

At the moment there are no signs that this is happening, indicating that perhaps Brexit is still seen as ‘someone else’s problem’, but if a spike in savings ratios were to happen then we believe that it would lead to a short, sharp slowdown in retail sales growth.

While the latest CIPS surveys are pointing to the economy flat-lining in Q1 2019, they generally tend to undershoot in times of heightened uncertainty. Other surveys, such as the BRC retail sales data and the SMMT data on new car registrations support a more optimistic view of marginal positive growth, even as the stopwatch counts down on Brexit.

Assuming that a full disorderly exit from the EU does not happen at the end of March 2019 leaves us with a modestly positive view for the UK economy this year and next. There are few reasons to suggest that interest rates will move up sharply in the short term, and this combined with low savings rates will support average annual growth in both real disposable incomes and consumer spending of around 1.8% per annum over the next five years.

.jpg)

.jpg)