The investor caution of 2018 is likely to give way to selective opportunistic buying in 2019

Just over £2 billion of retail warehouse assets were traded in 2018, making last year the weakest year since the nadir of the global financial crisis in 2012. While the first three quarters of 2018 were on a par with the same period of both 2016 and 2017, only £294 million was transacted in the final quarter of the year.

.png)

Retail warehouse investment volume was 28% down on 2017, but proved more resilient to investor caution than shopping centres and high street shops which were down 33% and 31% respectively

Source: Savills Research

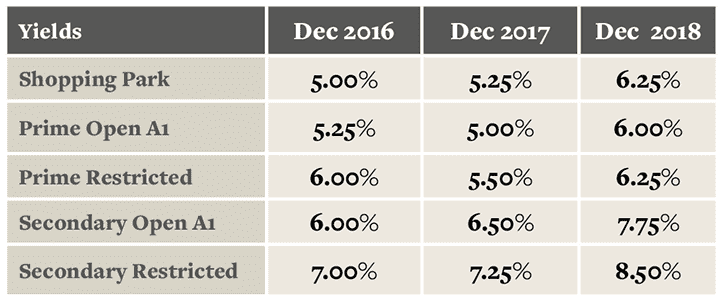

Investor caution also had an impact on pricing last year, with the spread between prime and secondary yields continuing to widen. For example, while Prime Open A1 and Prime Restricted park yields have softened by 100bps, their secondary equivalents have softened by 125bps over the last 12 months.

The big question for 2019 is whether these corrections are enough, or whether a lack of transactional evidence has delayed further repricing.

One thing that the repricing has done is stimulate investor interest in the sector, both from non-domestic and domestic investors. Not only are these new entrants to the market speculating that the fundamentals of the sector are comparatively solid, but they are also attracted by the wider variety of willing sellers that are present in retail warehousing compared to some other asset classes. The rationale of these largely opportunistic investors is simple, the ability to deploy comparatively large volumes of capital into a sector where values have either fallen too far, or have fallen far enough to support rent cuts and hence enhanced lettability.

The other group of investors that are currently running their slide rule over the sector are the trader-developers. Their interest is in the low occupational density of retail warehouse parks, and the ability to deliver alternative uses such as residential or logistics either on the same site as retail warehousing, or in place of it.

Given a degree of valuation lag we expect that capital values, at least on the MSCI metrics, will continue to fall this year. This will probably inhibit some purchasers from acting, as well as meaning that some vendors will delay. However, we do not expect as much yield softening at the prime end of the market this year as we saw in 2018.

If, as we suspect they will, some major opportunistic investors enter the market this year then they will probably foreshadow the bottom of the cycle, both in terms of pricing and investment turnover.

While risk-adjusted returns are starting to look tempting there is still a wide gap between vendors and purchasers expectations. Delivering deals will depend on squaring this circle.

.jpg)