Market overview

Despite its strengths, Bournemouth, Christchurch and Poole has challenges including transport, productivity and housing provision

.png)

Despite its strengths, Bournemouth, Christchurch and Poole has challenges including transport, productivity and housing provision

Infrastructure

Travelling across the urban area by car is slow and congested, and there are limited connections to the north and west. Rail links make it possible to travel from Christchurch to Poole more quickly, taking 20 minutes, albeit services only go every half an hour and locations away from stations remain less accessible. London is nearly two hours from Bournemouth via train, with trains running every hour, putting the capital beyond a daily commute. Improving the transport infrastructure will be vital to enabling growth in the area.

Productivity

Productivity in BCP is significantly below that of Bristol and Southampton. The retail and tourist industries are major employment sectors but both have low productivity. Many work in the low paid health and social care sector, which despite employing 15% of workers, generates only 11% of BCP’s economic output (GVA).

But the large and growing health and social care sector supporting BCP’s older population provides a great opportunity to test innovative health care solutions. There are a limited number of health innovation companies in the area and investment into providing space for similar companies could help build this into a USP, particularly given the strengths of Bournemouth University in the health and social sciences sector.

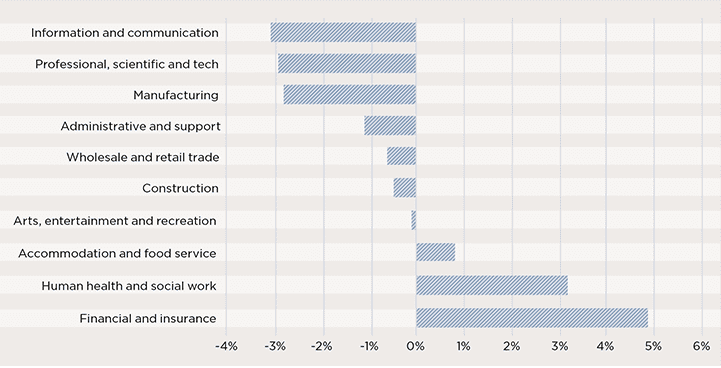

BCP generates a lower proportion of economic output from information and communication and professional, scientific and tech than the UK. However, these two sectors are forecast to grow the most in BCP over the next 10 years. Building on the new university teaching facilities, investment in the right space and support will be needed to ensure they have the ability to grow.

Bournemouth retains 22% of its graduates, just below the 28% average across 43 University towns and cities monitored by Centre for Cities. However, it struggles to attract graduates from other places ranking 42nd out of 63 towns and cities for net gain of graduates each year.

In comparison, Bristol and Southampton are much better at attracting graduates and rank 4th and 16th respectively. As well as struggling to attract graduates, BCP has had relatively low levels of investment and struggled to grow in the way it did in the 70s and 80s when it attracted major financial companies to the area.

Economic output Proportion of GVA in Bournemouth, Christchurch and Poole compared to the UK

Source: Oxford Economics

Housing provision

At a headline level, housing is relatively unaffordable in BCP. House prices are 9, 10 and 12 times average earnings in Bournemouth, Christchurch and Poole respectively compared to the national average of 8. Theoretically, someone earning the average wage in BCP could afford a home up to £160,000 with a 25% deposit. This only covers 15% of stock in the area.

There is a wide disparity in affluence across BCP with areas in both the top and bottom percentiles in the country. This is reflected in the range of house prices in the area. The interquartile range (middle 50%) of house prices in BCP is 14% wider than that for Bristol and 60% wider than in Southampton.

Therefore, the new unitary authority will need to deliver many more homes affordable to locals, across a range of tenures. Overcoming these challenges will be a key factor in transforming these three boroughs into one thriving city.

3 other article(s) in this publication