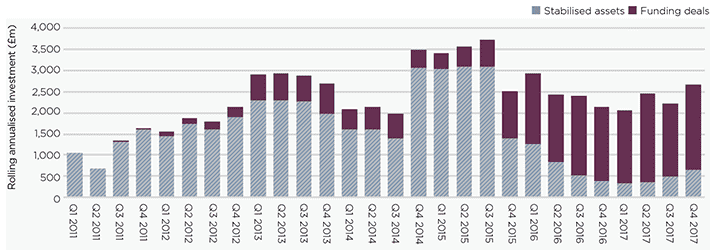

Investment into UK BTR reached £2.7 billion in 2017, up 23 per cent on 2016 and 4 per cent on 2015. It’s a sign of investors’ confidence in the sector that these volumes have held up, despite the headwinds of Brexit uncertainty and a surprise General Election.

But still, the value of BTR stock traded last year is essentially the same as it was five years ago. What happened to the ‘wall of capital’ looking to invest in BTR?

While the value invested hasn’t increased substantially, the type of investors and how they deploy their funds has changed enormously.

Building for the future

In 2014, 87 per cent of deals by GDV were for stabilised, income-producing assets. Last year that proportion was just 27 per cent, as existing investors held onto stock to build platforms upon which to aggregate portfolios.

Just under £2 billion of last year’s investment was in forward funding and forward purchase deals.

This reflects where we are in the development cycle. There simply aren’t enough stabilised assets to meet demand, so investors have turned to funding development of their own stock – betting that strong rental growth prospects and the funding yield discount will compensate them for taking that risk. This has the added benefit in giving them a say in design and branding.

As these assets are let and start generating income, we expect to see more deals. Fully let assets will command a premium to vacant blocks for long income investors, just as we see in commercial property sectors. And there’s also likely to be a premium on larger portfolios where investors can achieve scale quickly, just as we see in the student housing market.

.png)

.png)

.png)

.png)

.png)