build to rent

Build to Rent assets can offset rises in the risk-free rate through narrowing the risk premium and delivering income growth

.png)

Build to Rent assets can offset rises in the risk-free rate through narrowing the risk premium and delivering income growth

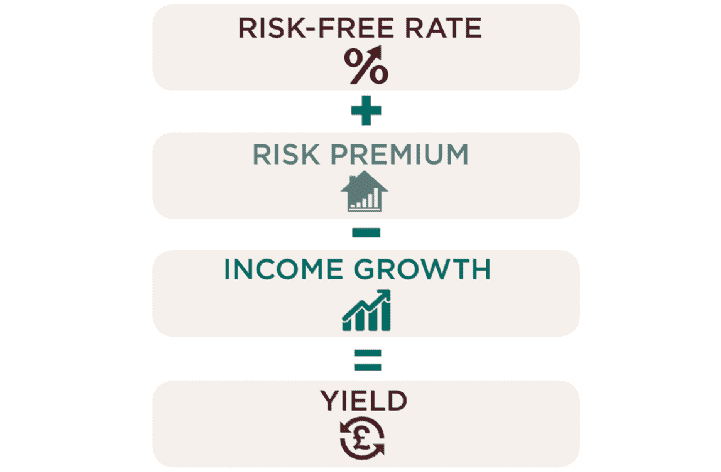

Going back to fundamentals, the yield of a residential asset consists of three things: start with the risk-free rate, add in a risk premium, and cut back to account for future income growth.

All three of these ingredients look set to change over the next five years. Looking at each of them in turn, we show that while rising risk-free rates will put upward pressure on yields, BTR can offset this by reducing its exposure to risk and delivering income growth.

1 Risk-free rate

Over the last 30 years, the returns investors could expect from the lowest risk investments – government gilts – have followed a distinctly downward trend. Black Wednesday, the Dot Com Bubble of the early noughties, the Global Financial Crisis of the late 2000s: each appears as nothing more than a brief blip on gilt yields' journey towards zero. Close behind, returns for other, riskier assets have fallen too, driving a corresponding increase in asset values. This direction of travel is about to change.

We have already seen the Bank of England raise base rates, and central banks across the world have made clear their intentions to tighten monetary policy further. However gradual and limited base rate rises are, any increase will leave us in the highest rate environment since 2009. Bank of England analysis shows how its quantitative easing and corporate bond buying programmes have depressed yields in corresponding markets. It does not take a wild leap of faith to predict rising yields as those programmes ease off.

These trends aren't just confined to the UK. Whether pricing off US Treasuries or the German Bund, investors face the prospect of rising risk-free rates.

All else being equal, this means asset values will fall.

.png)

Oxford Economics’ gilt rate forecasts

Source: Oxford Economics

2 Risk premium

The risk premium attached to BTR currently reflects a trade-off. On one hand you have the much-heralded ‘security’ of income stream. On the other, you have the risks associated with a relatively immature asset class, uncertainty over the scale of the opportunity, and the threat of regulation.

Comparable evidence, trading opportunities, and suitable sites are all in short supply. The premium associated with these risks will naturally shrink as the UK BTR market matures. Planners will become more familiar with the BTR model. We will see a growing body of evidence showing how fast the market can absorb large volumes of new rental stock.

This will help determine the size of different submarkets and the need for diversification of product. Some of these risks, such as regulation, will be outside of the control of investors. Other risks, such as those relating to finance and construction, can be offset by an active mitigation strategy. This will be crucial at a time of rising gilt rates.

If the BTR sector can offset any growth in risk-free rate by compressing its risk premium, we will see values maintained relative to other asset classes. But fundamentally, rental growth prospects are crucial to value growth.

While the risk-free rate is set to rise, we believe that as the BTR sector matures, the risk premium attached to the asset class will narrow. Rental growth prospects should therefore underpin capital growth and ensure competitive returns.

KEY TAKEAWAY

3 Income growth

Residential property can boast a long track record of rental value growth. Residential rents grew 20 per cent over the last decade, compared to just 8 per cent for ‘All Property’ rents (dominated by commercial assets). While commercial property can show stronger rental growth in individual years, it is far more volatile than the residential sector. For long-term investors seeking stable income returns, steadily growing residential returns are a much more attractive proposition.

In particular, residential rental income will appeal to anyone who needs income that grows in line with wage and pension liabilities: residential rents grew approximately in line with wage growth over the last five and ten years.

The fundamentals supporting the residential rental market are strong. The population in the UK continues to grow. Housing availability is constrained and access to home ownership and social housing limited: deposit affordability and access to mortgage finance is restricting owner occupation, while access to social rented housing requires a long spell on the local housing waiting list.

Meanwhile, unemployment is at a record low and rental growth is starting to pick up. Oxford Economics predicts that average earnings will increase 17 per cent by 2022. In strong employment markets with limited housing supply, rents are likely to follow suit. With all that in mind, robust rental growth looks set to continue.

.png)

Growth in rental income, wages and inflation

Source: MSCI, ASHE, ONS

Do we undervalue development risk?

How much of a discount should investors apply when funding development compared to acquiring operating assets? Evidence from recent transactions suggests investors are assuming a yield discount of as little as 50 basis points for entering the market via forward funding transactions.

That’s a small discount, given the additional indirect construction risk and direct market risk in letting entire schemes, and indeed on the sheer delay to the income stream (albeit many investors are electing to charge a ‘coupon’ to combat this).

It’s a demonstration of just how much competition there is amongst investors to access bespoke BTR investments that they’re willing to price such risks so competitively. As the development cycle moves on, and we see more stock available to trade, we expect development risk pricing to move away from 50 basis points.

6 other article(s) in this publication