Abstract

The market is settling and there is more realism in terms of price expectations

.png)

The market is settling and there is more realism in terms of price expectations

The annual number of residential transactions in the Aberdeen area has settled around 8,000 since the beginning of 2017, following the peak of 11,300 four years ago.

Transactional activity was supported by a strengthening second hand market in Aberdeenshire for properties completed to a high specification. Transactions above £600,000 in city locations also witnessed a modest recovery.

Transactional activity in Aberdeen City’s new build market also improved, supported by incentives, particularly in the price bands up to £400,000. This reflects ongoing demand for more attainable supply. Meanwhile, activity above £700,000 recovered in the city’s traditional hotspots.

Local markets

Within Aberdeen City, the West End and the sought-after suburbs of Bieldside, Cults and Milltimber led the recovery, with a 10% annual rise in transactional activity. In Aberdeenshire, the strongest growth in transactions last year took place in locations that are within easy reach of Aberdeen, particularly those with train connections and amenities. These include Inverurie, Insch, Portlethen and the hotspots of Banchory and Stonehaven.

More realistically-priced stock on the market

The amount of available mainstream second hand stock remains high. Above £400,000 however, supply is less saturated and this is being reflected in improved transactional activity in some areas. Whilst just over half of the overall stock has been unsold for a number of years, there are now more realistically-priced mainstream properties being launched.

Properties offered to the market in good condition and correctly priced continue to attract strong interest. However, the market remains challenging for remote houses in poor condition. For these properties, significant price adjustments or upgrading will be a necessity.

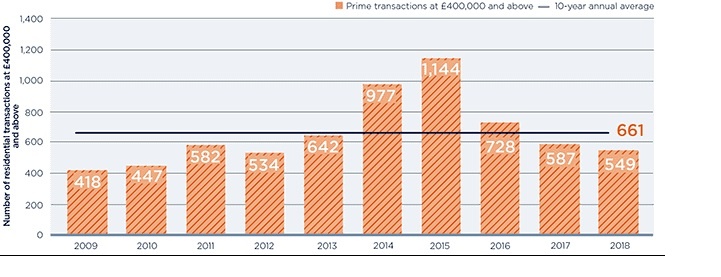

FIGURE 6 | Aberdeen area and North East prime transactions at £400,000 and above (year to June) Activity is settling close to the long-term average.

Source: Savills Research

Prices beginning to stabilise

High stock levels have impacted house price performance in the Aberdeen area. Since peaking at £199,285 in September 2014, the average house price in Aberdeen City has fallen by 20% to £159,507 in June 2018.

The fall from peak to trough has been less severe in Aberdeenshire, where the average price dropped by 8% from £202,570 in April 2015 to £186,765 in February 2017. A modest recovery narrowed that gap to 7% in June 2018.

At 4.5%, our Aberdeen area residential values five-year forecast reflects recent stability in average prices and transactional activity. A number of major projects provide hope for both the local economy and housing market. These include the Aberdeen Western Peripheral route, which will benefit surrounding villages and settlements.

The wider North East

The transactional market in the wider North East areas of Angus, Dundee and Moray has grown in higher price bands over the last year, leading to a 2% rise in the overall average price. Activity above £200,000 increased annually by 12% and the prime market reached a 10-year high of 90 transactions during the year ending June 2018.

Following a stable three-year period, the prime market above £400,000 in Angus recovered, with 37 transactions recorded over the last 12 months.

A lack of new build supply in Dundee prevented growth in overall transactions in the last 12 months, despite a stable second hand market. Meanwhile, prime transactions remained unchanged at 30, which is the highest annual number in a decade.

Transactions above £300,000 in Moray increased from 66 during the year ending June 2017 to 92 during the year ending June 2018. The rise in higher value activity supported the 5% annual increase in Moray’s average price.

5 other article(s) in this publication