Abstract

An increase in sales activity across higher price bands has driven growth, with new build values in the best locations reaching new heights

.png)

An increase in sales activity across higher price bands has driven growth, with new build values in the best locations reaching new heights

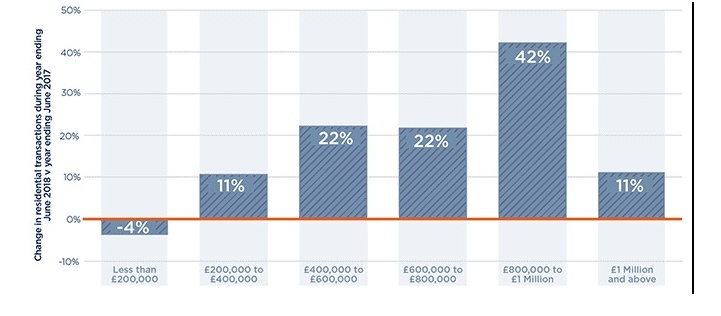

Greater Glasgow has witnessed transactional growth in higher price bands, thus leading to rising house prices. Activity above £200,000 increased annually by 12% whereas prime transactions above £400,000 increased by 23%. This resulted in 6% annual growth in the average transaction price during the year ending June 2018.

FIGURE 4 | Greater Glasgow annual transactional change by price band Growth across higher price bands has pushed up prices

Source: Savills Research

Prime hotspots continue to flourish

Across Greater Glasgow, strong premiums are being achieved where a significant level of demand can be channelled to properties that are well-presented and launched to the market at realistic prices.

Prime transactions in the city area of Glasgow reached a 10-year high of 371 during the year ending June 2018, led by the hotspots of West End, Park, Partick and Jordanhill. Together, these locations made up nearly a quarter of the prime Glasgow city area market.

The market in Pollokshields and Newlands continues to recover, with 61 transactions taking place in the same period. The second hand market across all prime city locations has performed strongly between £400,000 and £800,000 and also above £1 million.

The new build market has led the price band between £800,000 and £1 million, with transactions taking place at The Botanics and Claremont Terrace.

The rise in higher value transactions led to a 4% increase in the prime Glasgow city area average price, from £539,115 during the year ending June 2017 to £559,146 during the year ending June 2018.

In East Dunbartonshire, which includes the hotspots of Bearsden and Milngavie, prime transactions reached a 10-year high of 258 during the year ending June 2018, led by a strong second hand market and more new build sales above £500,000.

A similar trend was also witnessed in East Renfrewshire, which includes the sought-after locations of Clarkston, Giffnock and Newton Mearns. Prime transactions reached a 10-year high of 290 during the year ending June 2018, supported by a strong second hand and new build market, mainly up to £700,000.

New build activity in Bothwell and Strathaven as well as lesser known parts of East Kilbride and Cumbernauld boosted the prime markets in Lanarkshire and also stimulated prime second hand activity.

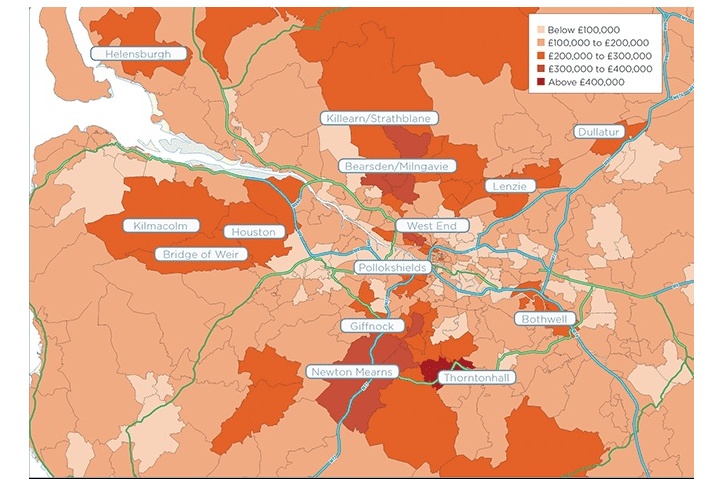

FIGURE 5 | Greater Glasgow average transaction price by postcode sector from July 2017 to June 2018 Price growth is spreading beyond traditional hotspots

Source: Savills Research

New build demand pushing out

Like any city, Glasgow’s new build market is not uniform. It is instead comprised of many smaller segments, each with their own demand and supply drivers.

The West End continues to be in high demand for developers and purchasers alike. Achieving between £400 and £450 per square foot, Park Quadrant Residences and The Botanics represent two of the biggest sites in this established market.

The strength of demand is pushing the market out beyond its traditional boundaries. Prices per square foot are now generally in the £300 to £350 range depending on location and unit size.

The south side of the city is also growing in popularity with the opening of well-reviewed independent restaurants giving this area a distinct vibrancy. Prices per square foot are most comfortable around £250 but the best locations are higher, even exceeding £300 in some spots. Meanwhile, the suburban market continues to perform in well-connected locations that have good access to schooling.

5 other article(s) in this publication