The demand for homes

In line with Birmingham’s economic renaissance, there is increasing demand for housing. Birmingham’s population is projected to grow by 150,000 (13.7%) by 2031.

The current Strategic Housing Market Assessment (SHMA) sets annual housing need at 4,057 new homes per annum, although the adopted target in the local plan is significantly lower at only 2,550 new homes per annum. Delivery in the year to March 2017 was still well short of this reduced target, at 1,750.

It’s not just in the overall numbers where delivery falls short. According to the 2013 SHMA, 38% of newly arising households need Affordable Housing, with the vast majority requiring homes for Affordable Rent. Although the balance of delivery of affordable housing was weighted towards Affordable Rent, overall affordable delivery only accounted for 20% of all new build completions.

What size?

It is also questionable whether the right mix of property types is being delivered. 54% of housing need is for three- and four-bedroom homes.

While we don’t have data on the breakdown of new homes by number of bedrooms, the distribution of new build property by floor space shows that 62% of new build sales in 2016 were properties of under 700 sq ft – suggesting that most new stock is one and two bedroom flats, rather than the family housing that is required.

This may be a consequence of the challenges of developing in the city centre, where sites require higher densities to be viable.

This underlines the importance of not just concentrating housing delivery in the city centre, but also allocating sites for housing in more suburban locations.

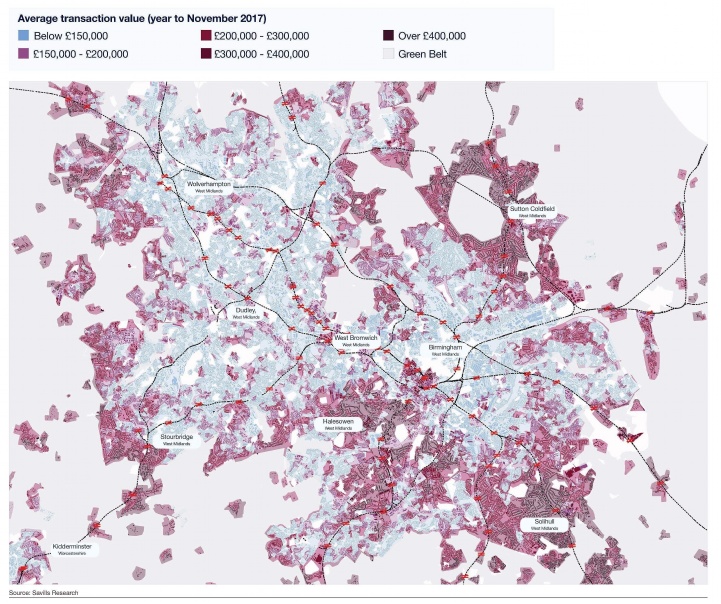

The recent release of greenbelt land for 6,000 homes at Langley is a positive step. But it will also be necessary for the surrounding local authorities to absorb overspill demand, particularly for family housing. To open up new sites, it will be crucial for the WMCA to continue to invest in the Metro rail network to maximise the potential of outlying stations. Homes within 2km of stations in the West Midlands have outperformed neighbouring areas by 12-16% over the past five years.