Birmingham is on the cusp of re-inventing itself. The Big City plan sets out an ambitious vision for the future. The HS2 train line “presents an unprecedented opportunity to establish the West Midlands as a world-class business location”. But the transport upgrade won’t do it on its own; Birmingham has to provide considerable new commercial, industrial and residential space to meet its ambitions. As confidence in the city builds, growth is spilling out from the core into new quarters beyond the ring road.

A bold vision for development in the city is unfolding thanks to investment in infrastructure

The city's strengths

A key driver for Birmingham’s transformation is the newly invigorated government structure. The West Midlands Combined Authority (WMCA) covers 21 boroughs and three local enterprise zones, providing a unique opportunity for strategic planning for housing, commercial space and infrastructure.

The WMCA has the largest investment fund (£1.1bn) of any of the combined authorities, but has more limited powers in several key areas; unlike Greater Manchester and Liverpool, it has no strategic planning powers, and cannot form Mayoral Development Corporations. It will also see the benefits of new funding announced in the Autumn Budget to drive the Midlands Engine.

A second devolution deal has been agreed in principle to address local productivity barriers, including £6 million for a housing task force and £250 million for intra-city transport.

Birmingham Airport had its busiest ever year in 2017, carrying over 13 million passengers, and has ambitions to further consolidate its position as a major regional hub by serving up to 20 million passengers a year.

Investment in infrastructure is also having a transformative effect. Shorter travel times to the capital are increasingly encouraging London based occupiers to consider northshoring their functions to the regional cities.

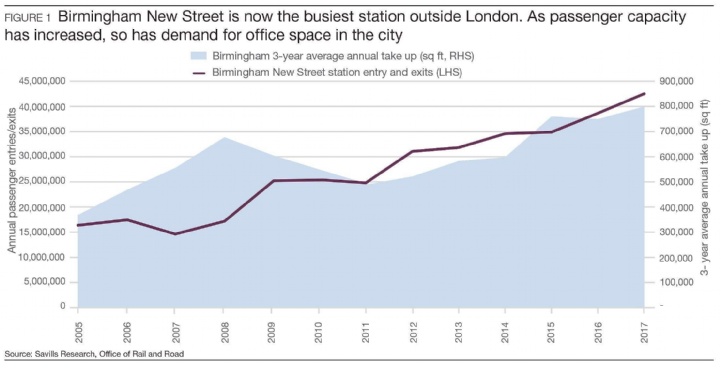

HSBC is on track to relocate over 1,000 jobs from London to Birmingham partially to reduce costs, whilst Deutsche Bank has expanded in Birmingham, with over 2,000 employees now located in the city centre. Three year annual average take up in Birmingham city centre now stands at 799,000 sq ft, 52% above the level recorded five years ago.

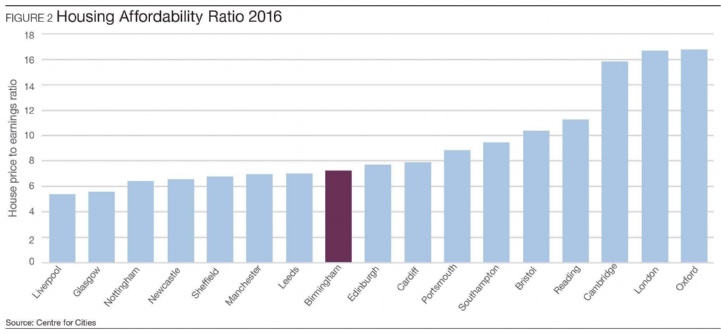

The average saving per employee for businesses relocating from central London to the UK regions is around £10,000 in staff costs and £10,000 in property costs. Housing is also much more affordable, with the average house price 7.2 times the average salary, in comparison to 16.6 times in London.

FIGURE 1 Birmingham New Street is now the busiest station outside London. As passenger capacity has increased, so has demand for office space in the city

Source: Savills Research, Office of Rail and Road

FIGURE 2 Housing Affordability Ratio 2016

Source: Centre for Cities

Challenges ahead

The West Midlands was the hardest hit region in England during the Global Financial Crisis. Although it has been rebuilding, with commercial investment in Birmingham reaching £1 billion during 2017, there are still significant challenges. Birmingham is the youngest city in Europe, with 40% of the population under 25. The city currently retains 49% of its students upon graduation, the second highest proportion outside London. However, only 28% of the city’s workforce have a degree, marking the lowest proportion among the major UK cities.

The city therefore needs to keep retaining graduates, and attract skilled workers from elsewhere. The UK Commission for Employment and Skills’ (UKCESS) report shows that the sector with the highest skills gap is engineering and advanced manufacturing at over 7%. With a number of contractors and associated consultants looking to expand in Birmingham off the back of HS2, and other large infrastructure projects underway, the supply of labour for this sector will become even more stretched. However, the recent let of 47,000 sq ft to WSP at The Mailbox for a new regional headquarters for 700 people suggests that companies are finding ways to fill the skills gap.

Delivering the transformation

There is undeniably a huge amount of brownfield potential; notably, Smithfield Market, the largest regeneration site in Europe. These schemes are becoming increasingly viable, thanks to strong house price growth of 31% over the past five years. There are over 6,500 residential units under construction, and a further 14,700 in planning.

The city needs to continue to identify a variety of sites, and ensure that development is supported by infrastructure to connect housing to employment hubs.