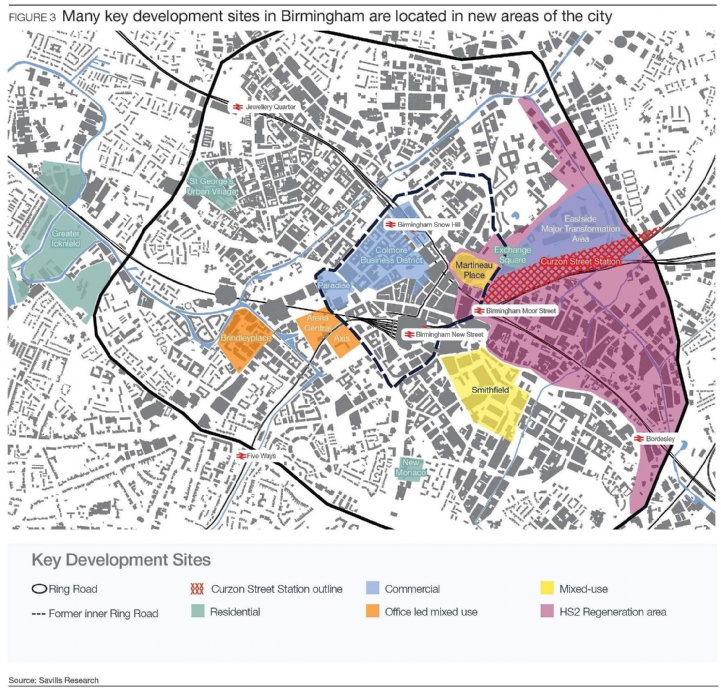

With mixed-use city centre regeneration schemes including Arena Central and Paradise both underway, Birmingham’s traditional office core is expanding to previously fringe areas. Innovation and flexibility in funding, tenure and design is bringing forward complex sites, resulting in the highest level of construction activity since the Global Financial Crisis.

Shifting focus

Strong commercial occupier requirements combined with a shortage of developable sites in the traditional core has encouraged developers to look beyond the former inner ring road and into previously fringe areas. The redevelopment at New Street station has improved access to the west of the station, supporting growth at Brindleyplace and Arena Central.

The first phase of 1.8 million sq ft of mixed-use development is currently underway at Paradise, of which PwC have pre-let 150,000 sq ft of office space. Arena Central will also provide 670,000 sq ft of office space when fully developed, of which the UK Government pre-let 240,000 sq ft at 3 Arena Central, whilst HSBC signed for 212,000 sq ft at 1 Centenary Square. Nearer the traditional core, Ballymore's 420,000 sq ft scheme at Three Snowhill shows significant confidence in the Birmingham market, and is expected to complete during Q1 2019.