The prime housing markets outside London may have only experienced modest growth since mid-2014, but they have outperformed the capital. Katy Warrick examines the future of the prime London market, while Kirsty Bennison looks at trends in the prime markets beyond the capital.

Prime London remains sensitive to change

26 April 2017 - Katy Warrick

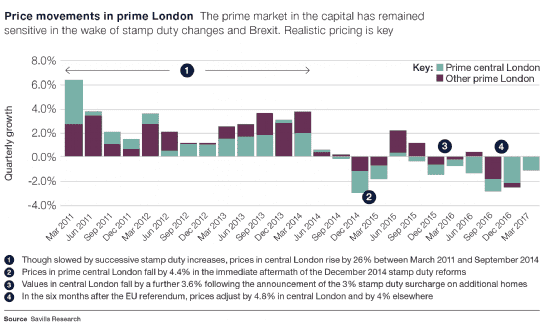

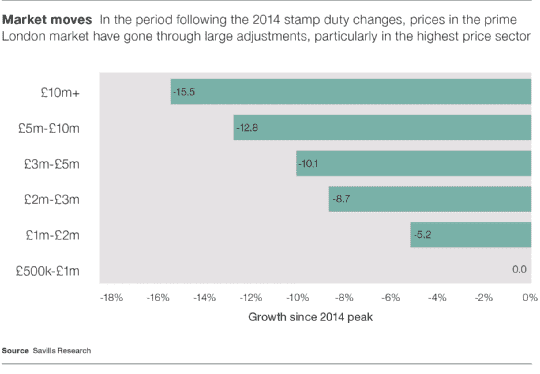

By the end of March 2017, prices in the prime London market had fallen by an average of 6.1% from their 2014 peak. For the prime central London market, the price adjustment has been a fall of 13.2%. Much of the blame has been laid at the door of stamp duty. However, this is just one element of the story.

Not just about stamp duty

In the immediate aftermath of the December 2014 stamp duty changes, prices fell by 4.4% in the prime central London market. They fell by a further 3.6% following the announcement of the extra stamp duty levy on purchases of investment property and second homes in December 2015. The scale of these falls reflect that the central London market has also been affected by international buyers’ increased exposure to capital gains tax and inheritance tax.

Together, these tax changes have served to make these buyers more reluctant to exploit the weakness of sterling. It also left the market more exposed to uncertainty following the vote to leave the EU, which triggered a further 4.8% fall in central London prices during the six months to the end of December 2016.

The other more domestic prime London markets, despite being rich in equity, have also been constrained by mortgage regulation. Buyers who need to borrow have begun to push against the limits of the loan-to-income ratios lenders are prepared to offer. Here, it was not until the Brexit vote that prices started to show some give, falling 4% in the second half of 2016.

This indicates Brexit uncertainty has compounded the cooling effect of stamp duty in the prime London market. To date, this has been down to sentiment, driven by uncertainty over the future, rather than any identifiable weakening in the London economy.

But the impact has been real and sellers understand they have to adjust expectations; asking over the odds for your property is a passion-killer for buyers.

FIGURE 1

Is London bottoming out?

TwentyCi tracks market activity and its data shows that, relative to the number of sales, since April 2016 there have been 70% more cuts in asking prices of prime property in London than in the country. But there is evidence these cuts are coaxing buyers back.Of course, the market remains price sensitive. In the first quarter of the year, prices in central London fell by a further 0.8%. Across the other London markets, they showed no movement. That suggests the market is finding its level. However, as the impact of serving Article 50 becomes clearer, it will be sensitive to the ebbs and flows of sentiment in uncertain times.

FIGURE 2

Stop-start in the town and country markets

26 April 2017 - Kirsty Bennison

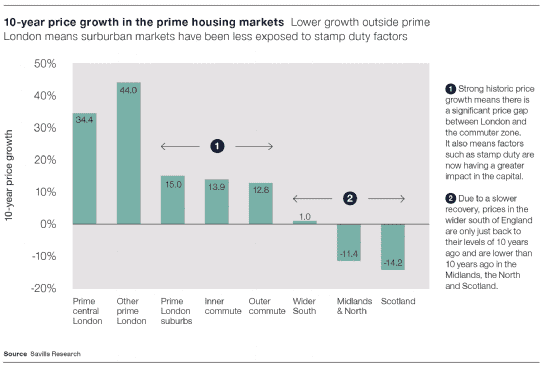

Beyond London, the prime market has seen some marked changes compared to those in the capital. Prices fell by a similar amount post-credit crunch, bottoming out in March 2009 after dropping by an average of 20% over 18 months. They then recovered over half of these losses in the following year. But between March 2010 and September 2014, there was little discernible growth. Modest increases in the commuter zone were offset by prices slipping back in the Midlands, the North and Scotland.

A market less exposed

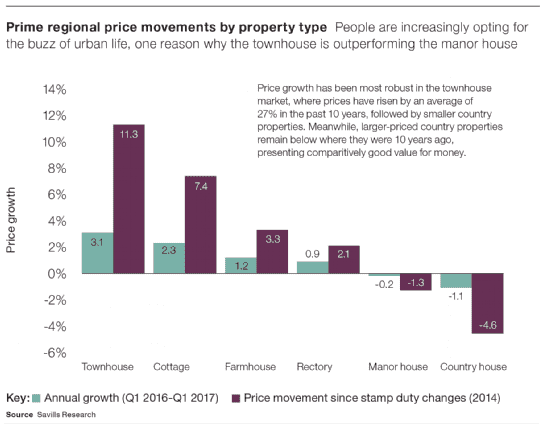

By the time of the major overhaul in stamp duty, prices were 4% below their 2007 peak on average. Even in the prime suburban markets, they were just 8% above the previous high-water mark. That has meant they have been less exposed to some of the factors that have caused London to falter. But they have not been immune to those pressures either. Total price growth since December 2014 has been confined to 4.4% on average, meaning that values are still only just back to their pre-credit crunch peak across the market as a whole. However, this broad average disguises some trends in the market. Where people have made the move out of London, for example, they have increasingly opted for the buzz and convenience of urban life; one reason why the townhouse has outperformed the manor house.

FIGURE 3

New trends in buyer preference

But that's not the only reason why prime urban property has outperformed its country counterpart, given the trend has extended well beyond London's commuter zone. The market for the best housing which the likes of York, Chester and Edinburgh has to offer has been more robust than for period country property. This suggests it is part of a wider change in preference.

For those who prefer rural life, it has been a case of small is beautiful, with a stronger market for cottages and farmhouses than grander, larger stock, which increasingly looks like good value.

Early evidence for 2017 is one of cautious optimism. Prices rose by 0.8% in the first quarter, but modest growth across all regions beyond London and in all price bands, reflects a more fluid market than London, which is more exposed to changes in sentiment.

FIGURE 4

.png)

.png)

.jpg)

.png)

.png)

.jpg)

.jpg)

.jpg)