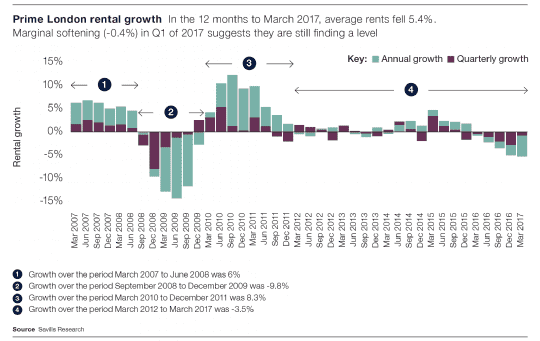

In the 12 months to March 2017, average rents across prime London fell 5.4%. Further marginal softening (-0.4%) in the first quarter of this year suggests they are still finding a level. The most significant falls were seen in the highest-value prime central London markets, which were down 8% in the year.

Newly completed homes coming to the rental market, investors rushing to beat the introduction of the 3% stamp duty surcharge for investment properties in March 2016, and weakening demand from corporate tenants have combined to inflate the amount of stock being added to the market.

However, despite being price sensitive, the prime rental market has remained relatively active. London still retains its reputation as a global city, so demand remains strong. However, increased choice means tenants are focused on finding value and ‘best-in-class’ properties. Tenants are favouring new and newly refurbished stock over tired stock, so landlords need to invest to prevent voids.

The outlook for the London market sees a series of challenges. While we expect strong continued demand from young, affluent households facing a significant deposit hurdle to buy their first home, the strength of rental demand from other tenant groups will be more dependent on the outcome of EU negotiations and London’s ability to remain a global financial centre.

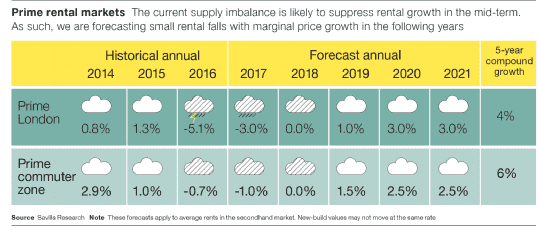

In addition, the current supply imbalance is likely to suppress rental growth in the mid-term. As such, we are forecasting small rental falls in prime London in 2017, with marginal price growth in the following two years. With this in mind, landlords will need to remain realistic in their price expectations, while offering stock of the best quality to capture demand.

.png)

.png)

.png)

.jpg)

.png)

.png)

.jpg)

.jpg)