ECONOMIC OVERVIEW

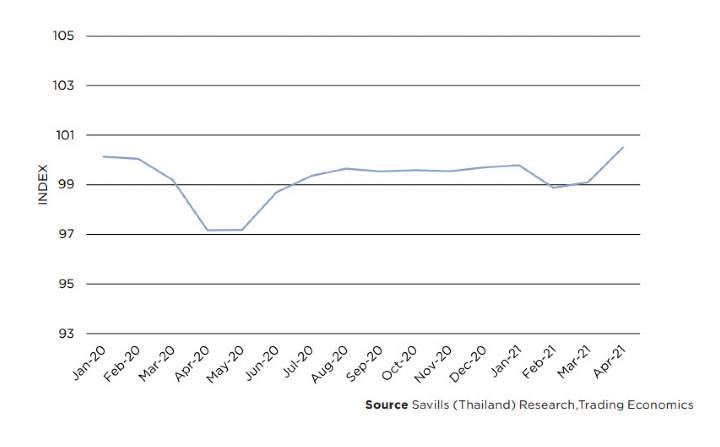

April 2021 saw the emergence of a third wave of COVID-19, which appears to be the worst yet experienced by the country. Coupled with the delayed mass vaccine rollout, which is now expected to begin in June this year, and national vaccine skepticism, forecasts of a recovery are being minimised and timelines extended. The Bank of Thailand has revised their GDP forecast down from 3% to between 1-2%, with the worst-case scenario based on the assumption that the country does not reach heard immunity within the year and that the rate of unemployment grows. In April 2021, the Consumer Price Index increased to 100.5 points from 99.11 points in March 2021 demonstrating a slight increase in prices for food and non-alcoholic beverages.

The Thai government has maintained it’s ‘sandbox program’ to allow vaccinated travelers to enter Phuket by August without quarantine, planning to expand the program into more key tourist destinations by Q4/2021. In April Thailand reduced its mandatory quarantine-on-arrival period from 14 days to 10 or 7 days for vaccinated travelers. However, due to the third wave of the virus, the Thai government announced a reversal of this plan and now requires all arrivals to quarantine for the full 14 days.