MARKET OVERVIEW

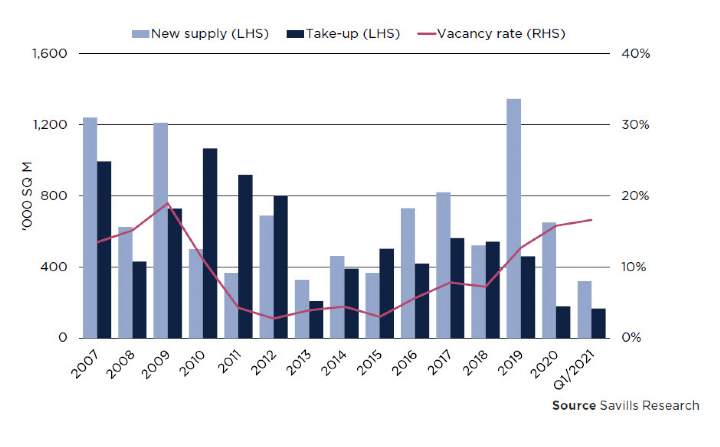

As the pandemic was effectively contained in China, the domestic economy rebounded with GDP’s double-digit growth in Q1/2021. Meanwhile, Beijing’s Garde A office market also bounced back at the beginning of the year. As a result, the citywide net absorption in the first quarter soared to 166,034 sq m. More impressively, the Q1 absorption rate was equal to 94% of the total annual absorption for 2020. Three new projects were launched in Q1/2021, bringing a total of 318,363 sq m to Beijing’s Grade A office market. The average vacancy rate stayed at a relatively high level of 16.6%, and the average rent dropped 4.2% year-on-year (YoY) to RMB344.9 per sq m per month in Q1/2021. Information technology, finance, professional services and healthcare companies were the top demand drivers for office space, collectively accounting for 70.5% of the total leased area in Q1/2021.