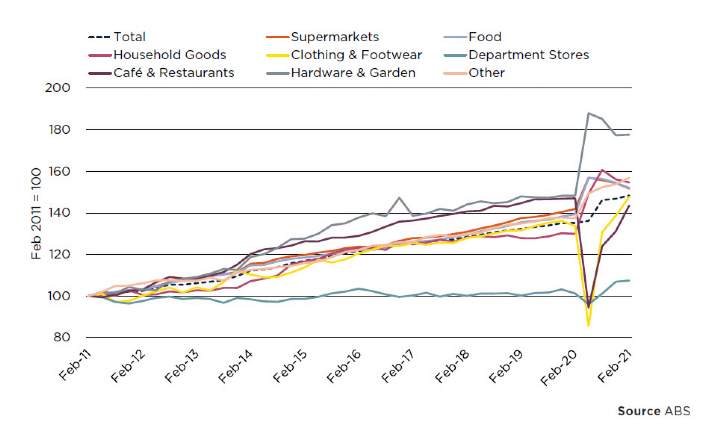

The Australian economy continues to demonstrate a strong rebound following falling into a recession in June 2020. Throughout 2020 Australia’s Gross Domestic Product contracted by -1.1% on the back of widespread economic disruption as a result of COVID-19. With the pandemic causing many retailers to close due to Government imposed lockdowns and foot traffic drastically reduced, retail property was negatively impacted. It is worth noting that this was mainly skewed towards Regional and Sub-regional centres with high exposure to fashion retailers and other specialty tenants. Supermarket anchored neighbourhood centres as well as large format centres have continued to perform well and a clear divergence between discretionary and non-discretionary centres has become apparent in both sales and leasing metrics.

Australian retail property: a divergence between subsectors

RETAIL RETURNS

According to the latest MSCI data (December 2020) returns for retail recorded negative growth over the 12-month period, which was driven by falls in capital returns. Positively, income returns remained stabled over the year, particularly for country retail. The by the COVID-19 pandemic had a far greater impact on Metropolitan retail, with overseas tourism non-existent and reduced foot traffic particularly within discretionary retail and CBD centres. This was not only due to the work from home orders that were in place for most of the year, but also from a sharp decline in the number of international students.