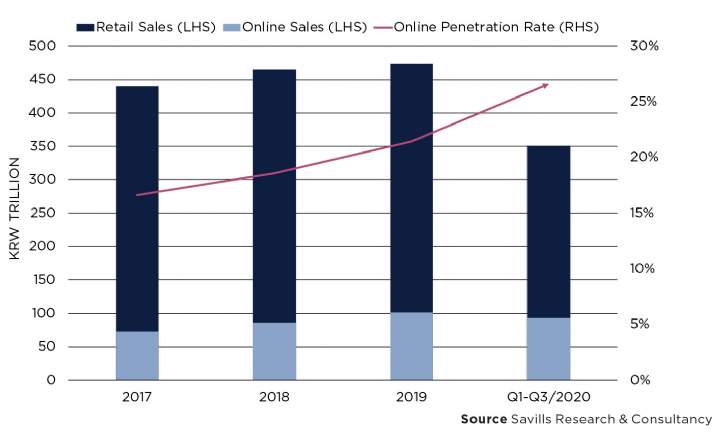

Online Sales Growth

Online retail sales grew a remarkable 7% YoY in 2020-YTD, while total retail sales increased 1% during the same period. The shift from offline to online retail is rapidly materializing, as online retail sales, only 17% of the total in 2017, rose to 27% in Q1-Q3/2020.

By product category, Food & Beverages exhibited the most significant growth in sales. On the effects of the pandemic-related lockdown, online sales of Food & Beverages rose 48% YoY, and Agricultural & Livestock Products by 71% YoY. As a result, high demand for cold storage has fostered more investment interest in cold storage developments in 2020.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)