Introduction

Tokyo’s ultra-luxury residential market is underpinned by a high concentration of UHNWIs in Japan and increasing overseas interest. Although the market was historically considered undersupplied, the tide has been changing over the past few years, with leading players such as Mitsui Fudosan and Mori Building paving the way. Encouraged by potential growth in this sector, new international players have also ventured into this segment.

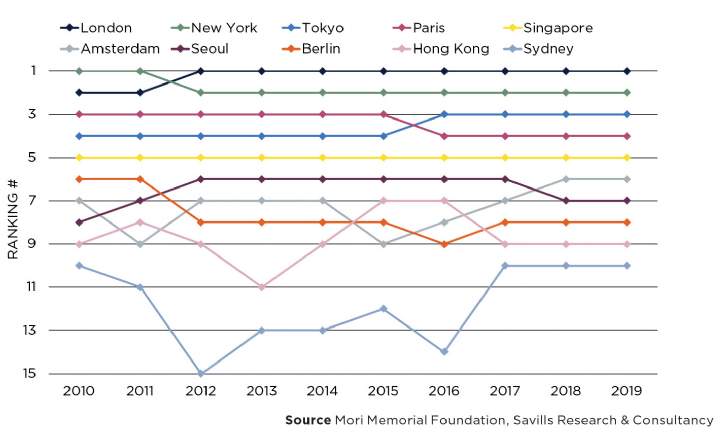

As Tokyo continues to go through a large redevelopment phase and solidify its status as a global destination, high-quality residential properties in prime locations should see increasing popularity. Recognised as a dynamic mega-city with a stable political environment and rule of law, as well as great access to world-class attractions, Tokyo is a low-risk environment where UHNWIs can comfortably store wealth.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)