Readings from across the globe

"Starting with Jane Austen and ending with Emily Brontë, Kelcie Sellers of our World Research team takes inspiration from the world of literature in putting the prime residential markets of London into a global context"

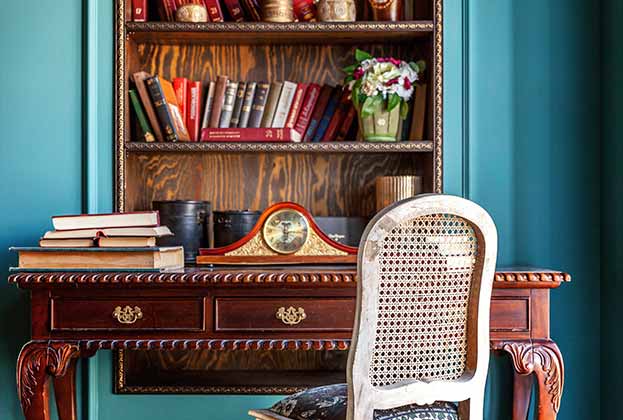

.jpg)