Outlook for the future pipeline

However, lead indicators for the future pipeline suggest that housebuilding will fall over the next couple of years. The number of EPCs for new dwellings granted so far in 2023 suggests that total delivery for the calendar year will be around 225,000-230,000 homes, and we anticipate further falls in 2024. These falls will be driven by ongoing weakness in the sales market, and a lack of new sites coming through the planning system.

Only around 257,000 homes have gained planning consent in the twelve months to September 2023, according to HBF and Glenigan data. This is the lowest annualised figure for planning consents since September 2015, and represents a -24 per cent fall from the peak flow of consents in the year to June 2021.

Without a sufficient supply of newly consented sites, the housebuilding industry will not be in a position to expand delivery, even once the sales market begins to recover from mid-2024. As a consequence, delivery is likely to fall even further below the Government’s target of 300,000 new homes per annum.

The lack of planning consents is compounded by a continued fall in the number of homes being built through change of use. Since the peak of development via change of use in 2016-17, volumes have fallen by -40 per cent, with 22,160 homes (9 per cent) delivered via this route in 2022-23. Office to residential still makes up the bulk of change of use, but volumes were down -55 per cent in 2022-23 compared to the 2016-17 peak.

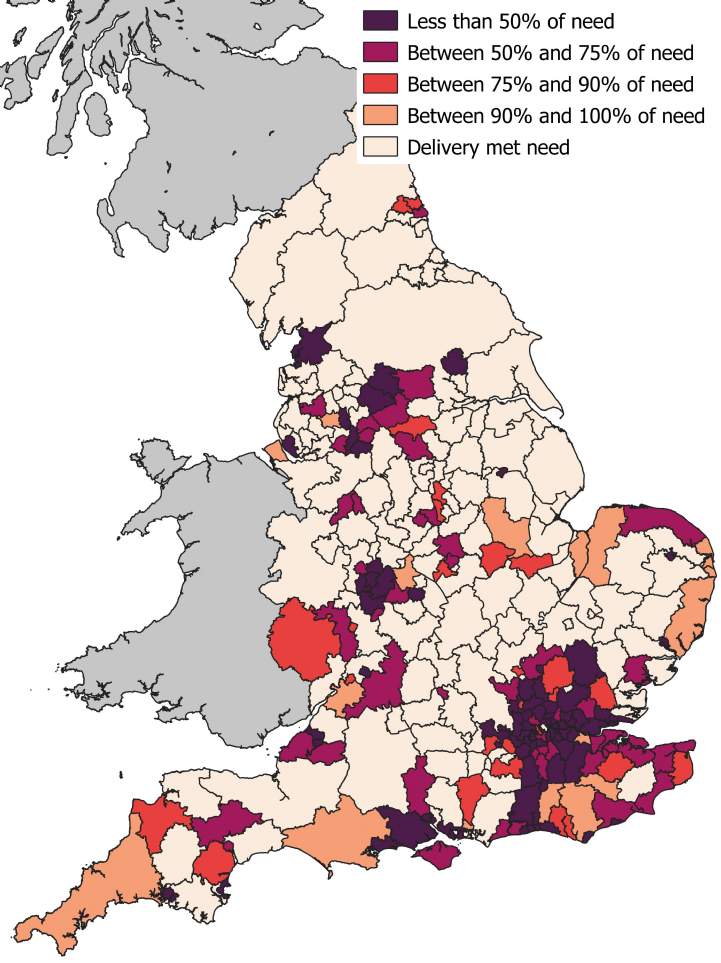

Meeting need across the country

London was the region with the largest fall in delivery compared to the previous year. There were 35,300 net additions in 2022-23, down -10 per cent. This is well short of the London Plan target of 52,000 homes per year, and even further from the 90,000 homes required to meet housing need and improve affordability.

Development in London has been hampered by slowing sales rates and falling values, combined with a sharp increase in build costs and changing design requirements including dual staircases for tall buildings. It is hard to see how this trend will reverse in the near term, with housing starts in the capital down -60 per cent from their 2014-15 peak.

2022-23 net additional dwellings against standard method housing need

.jpg)