Get an insight into the development in the Copenhagen office market and our expectations for the future office market.

.jpg)

Read about market development, market trends and five strong expectations for the future office market.

Market development

Figure 1 | Employment and vacancy in Copenhagen

- Steadily increasing employment in the Capital Region of Denmark creates the foundation for an increased need for office workstations and accordingly an increased demand for modern office space.

- Occupier demand for Copenhagen office space has maintained a sound level in recent years. Copenhagen office vacancy is estimated to be 7.2 % in Q1 2022 and 6.8 % in Q2 2022.

- Covid-19 temporarily reduced employment, but the particularly exposed industries have had limited impact on the office market.

- In the period 2021-2025, total office space in Copenhagen city is expected to increase by around 390,000 square metres. Quality and concept, including convenience, sustainability and productivity are expected to become decisive, competitive parameters.

- The Copenhagen housing market limits employees’ options to allocate an area for home office.

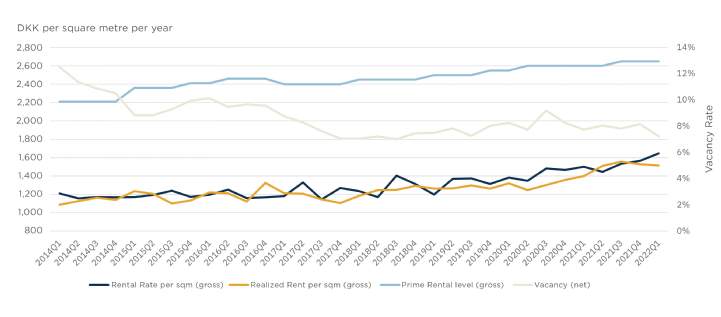

Figure 2 | Copenhagen office rent levels and vacancy

Info: Percentage-wise change in realised rent in the period 2019-2021. 2019: Approx. 2.50%, 2020 approx. 6.00% and 2021 approx. 5.75%

- Rent levels have shown increasing tendencies in the recent period, although the realised rent levels are finding a more stable level.

- In Q1 2022, Copenhagen office vacancy is estimated to be 7.2%. Compared to the same time last year, office vacancy in Copenhagen City has decreased by 0.5 percentage points.This should be considered in relation to the significant amount of new office space, which was built during 2021 and subsequently became part of the letting supply.

- Rent levels peak in Copenhagen City centre with a prime gross rent level of approx. 2,750 DKK/sqm/year. Average annual rent in the area has been approx. 1,800 DKK/sqm/year.

- The letting supply has developed stably over the past year with the addition of several modernised and newly built properties. Moreover, we have observed that several projects are commenced and put out to tender, which will further increase the supply over the next few years.

- Several of the commenced projects are focused on sustainability and the related certifications, as many companies consider the green transition a vital parameter in their choice of a new lease.

Market trends

Figure 3 | The workplace ecosystem

- The workplace must provide the framework for an ecosystem where employees thrive.

- In the future, office buildings will function as hubs for collaboration, innovation, and interaction, but in a more flexible environment than what we are used to.

- The workplace is arranged to create synergy between employer and employee, as well as improve productivity and creativity.

- Future offices must support the concept, identity, and

- brand DNA of the companies.

- The workplace must be able to attract and retain talent.

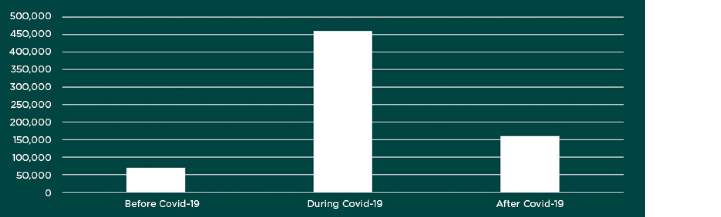

Figure 4 | Hybrid work and the effects of Covid-19 on the office market

Estimated number of people teleworking.

Data based on survey of 1,101 companies with ~118,000 employees

- More companies are planning to move to more flexible workplaces that can support hybrid work after positive experiences during the Covid-19 pandemic lockdowns.

- The crisis has resulted in approx. 90,000 additional people wanting to work remotely.

- Several leading companies in Denmark are introducing two fixed weekly teleworking days.

- There is an increasing focus on creative and flexible layouts and optimisation of the physical environment.

- Companies show an increasing need for more flexible office space, including scalable options so the office can be scaled up and down as needed.

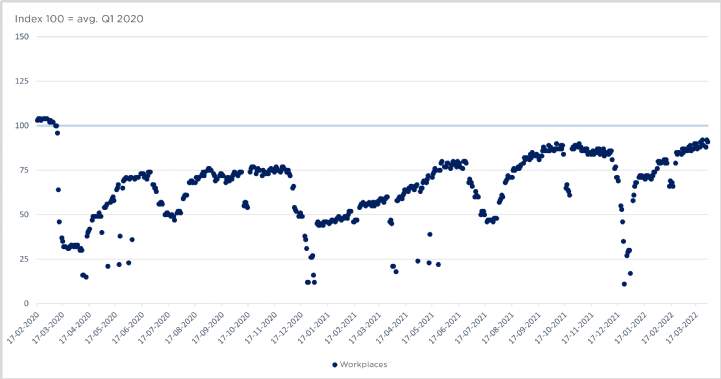

Figure 5 | Teleworking and new ways of working

Source: Google Mobility Data

- Data shows that Danes work from home an average of one day a week. This indicates that Danish employees in Copenhagen mainly want to work in the office.

- Workplaces are increasingly designed with a focus on creating a workspace with relevant and desirable offers and services for their employees.

- Increased focus on culture, layout, design, and working methods that benefit employees.

- In Denmark, there are strict government requirements for workplace layout in terms of area, flooring, surface, daylight, and noise, which limit how much companies can reduce their total office area.

Companies that focus on the social element of ESG will begin to increase their average floor space per employee to accommodate employee expectations.

Predictions and expectations

The Copenhagen office market is characterised by high demand from investors and occupiers. Investor interest is focused on existing office properties as well as office projects. We have seen an intensified investment interest in office properties with development potential. Modern companies are looking for attractive office space that offer ideal conditions for growth. The workplace must provide the framework for employee well-being.

This development places new demands on the layout of the future office, which must also include open spaces and areas for social events. The supply of modern office space in Copenhagen City is limited and companies are challenged in terms of finding suitable office space. A low supply and a high demand keep office rents at a high level. Similarly, investment interest is reflected in low required rates of return. Despite these market conditions, Denmark and Copenhagen remain among the world's most attractive countries for foreign office investments.

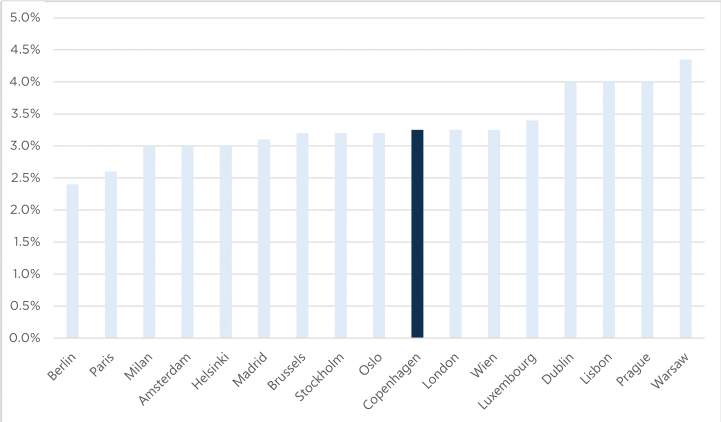

Historically, Copenhagen is under-priced in terms of yield levels compared to other major European cities.

On the investment side, investors still consider Denmark an attractive country for investments. Investors are primarily focused on Copenhagen, but the Aarhus area is also experiencing sound investment interest in the office segment. For prime office properties, the yield level in Copenhagen is around 3% for the most attractive properties.

Five strong expectations for the future office market

- Major tenant rotation underway, which could lead to activity in the market.

- More hybrid office solutions with a focus on employees.

- Branding of office concepts and office hotels is gaining momentum.

- Continued uncertainty about the extent of hybrid work in the future.

- The office workplace continues to hold high value for companies and employees.