Ifølge vores opgørelse af transaktions-volumen er der på landsplan handlet ejendomme for 70,11 mia. DKK frem til udgangen af oktober 2021.

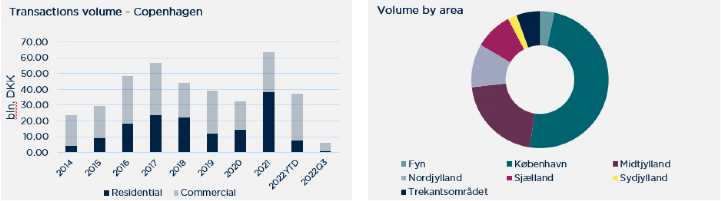

- Zooming in on Copenhagen specifically, 2021 has already exceeded the 2020 level, and nationwide, the volume for the first 10 months of the year is largely on a par with the total transaction volume in 2020. Accordingly, we suggest that 2021 may exceed the former record-year 2017. When transaction volume reached approx. DKK 95 billion. The biggest obstacle to achieving a new transaction record is the limited supply of properties for sale - especially in the largest cities of the country. There is a significant need for placing capital among the investors and a generally limited supply that struggle to match the intense demand from both Danish and international investors, says Jacob Lund, partner and CEO.

We have estimated a nationwide transaction volume to be DKK 70.11 billion, which as already at this time is roughly the same level as the 2020 transaction volume which reached a total of DKK 74.01 billion. With the transactions, we are currently aware of, 2021 will exceed 2020 and expectedly be on par with the record year 2017. This is confirmed by our Data & Research department.

More than half of the transactions are with multifamily properties, approx. DKK 39.51 billion, while commercial transactions account for DKK 30.60 billion. This distribution indicates that multifamily properties continue to be exceedingly attractive with the investors. This is the continuation of a trend we have seen for some time.

.png)

The 2021 transaction volume is in Q3 estimated to be DKK 32.11 billion. This is an increase of more than 250 percent compared to last year when the volume reached DKK 12.7 billion. Of the DKK 32.11 billion, DKK 16.82 were from transactions in the capital.

The capital has exceeded the 2020 level

The Copenhagen transaction volume for the first three quarters is estimated to be approx. DKK 34.3 billion and has thus exceeded the 2020 level. Across the country as well as in Copenhagen, investors have been particularly active with acquisitions of multifamily properties. Commercial properties account for approx. DKK 12.35 billion, while transactions with multifamily properties amount to almost DKK 22 billion of the total DKK 34.3 billion.

The Copenhagen transaction volume accounts for approx. 57 percent of the total transaction volume in 2021, while Central Jutland accounts for 15.5 percent and the Triangle Region for 7 percent.

Several significant transactions in Q3

The most active investors in 2021 Q3 are, on the buyer side, the Swedish Heimstaden with their acquisition of two significant multifamily portfolios in the price range DKK 2.5-3 billion. Other major investors that have acquired properties during the third quarter of the year include the Dutch Orange Capital Partners, which has acquired several multifamily projects during this quarter. Most recently a major PBSA project in Valby. In addition, Danish pension funds have also been involved in several transactions, including PFA with their acquisition of a multifamily portfolio of DKK 1.2 billion. On the buyer side, international investors were behind 78.73 percent of the transactions in 2021 Q3, while Danish investors accounted for 21.27 percent.

Active investors that have divested in 2021 Q3 include Akelius with their sale of 18 multifamily properties to Heimstaden. In addition, Danish Koncenton was the seller in the above-mentioned transaction with Orange Capital Partners, while P+ Pensionskassen for Akademikere sold a large multifamily portfolio in Copenhagen to PFA. On the seller side, international investors accounted for 27.92 percent, while Danish investors accounted for approx. 72.08 percent.

In total, more than 10 investors have acquired for more than DKK 500 million in 2021 Q3. DKK, while 12 have divested.

Strong finish

- The investment appetite for properties is strong and there is a significant amount of capital in the market, especially among the international investors. We are facing a couple of busy months towards the end of the year, and with the many significant transactions we have seen in Q3, a couple of large individual transactions in the final quarter may determine whether 2021 will be a new record year for transaction volume, concludes Jacob Lund.

(5).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)