As organizations are forced to make office space decisions based on lease expirations or other factors, they are evaluating their spaces, workforce, and external data such as commutation trends to make thoughtful decisions for the best interest of their company and their employees. With so many individualized variables at play for tenants, is it possible for there to be any consistency in the decisions that are being made by organizations and across various industries? In the near term, the answer is ‘Likely not,’ and because of this, there is only one consistency with office market trends, data, and tenant decisions – inconsistency.

Based upon daily interactions with Savills’ tenant clients and a November 2022 client survey, there is inconsistency and uncertainty across all, or even within, specific organizations and industries as to how office space and occupancy levels are being managed and how that may change in the future. Some organizations are driven by cost savings and/or how often their employees want to use office space, while other companies prioritize the importance of in-person employee collaboration, productivity, and training. All in all, organizations and even different departments within certain organizations' immediate desires around space use and their long-term objectives may differ significantly, which makes it difficult for the commercial office market to draw definitive conclusions as to how office occupancy will be impacted in the future.

One area of consistency for most employers is the objective to provide employees with a better worklife balance and working experience. This may take the form of relocating to a higher-quality office building with attractive amenities or providing flexibility with hybrid work scheduling. Increased deference to employee needs is often seen as essential when recruiting and retaining talent, which can mitigate costs associated with turnover and training. It remains to be seen if recent layoffs in specific industries, such as tech, will cause the pendulum to swing back toward the employer.

But What Does the Data Say?

Since the beginning of the pandemic, Savills has been studying data surrounding occupancy levels and trends in the commercial real estate market across North America. Tenants rely on this data to devise an informed strategy for their commercial office needs. In Philadelphia, we explored data points, including pedestrian foot traffic, office occupancy in the Philadelphia Central Business District (CBD), public transportation statistics, recent client survey feedback, and Savills day-today interactions with its tenant clients.

- Data suggests that pedestrian foot traffic and occupancy in office buildings within the Philadelphia CBD increased steadily throughout 2022

- Center City District reported the average daily population among residents, non-resident workers, and visitors reached 68% of 2019’s pre-pandemic levels in November 2022, with residents’ return (125%) outpacing non-residents (57%) and visitors (70%)

- Pedestrian foot traffic has increased 82% since January 2022 in the heart of Center City, and the greatest foot traffic increase has been felt in the CBD during and after business hours

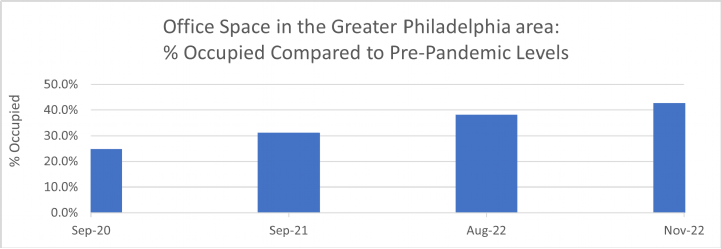

- Office occupancy in the Philadelphia CBD, has increased consistently since Labor Day 2020, up to 42.7% of pre-pandemic occupancy levels as of November 2022, with occupancy strongest Tuesday through Thursday and weakest Mondays and Fridays

.jpg)

(6).jpg)

(5).jpg)

.jpg)

.jpg)

(3).jpg)

.jpg)

.jpg)