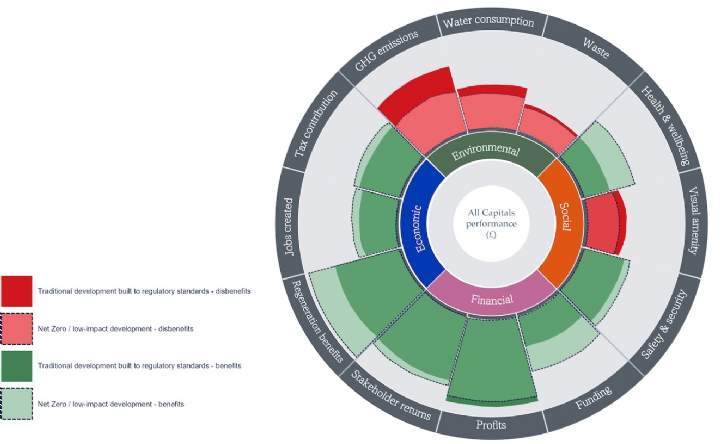

As the challenges that business are grappling with become ever more multi-faceted we need to embrace a more systems-based approach to decision-making within a real estate. In order to do this, our decisions need to be informed by all the capital resources we use. All Capitals Accounting (ACA) is an approach that aims to calculate and value the ‘total impact’ of an asset, project or organisation. It is also known as impact measurement, wealth accounting and natural capital accounting.

Under ACA, the impact of non-financial drivers such as greenhouse gas emissions and land use are valued using well-established economic methodologies. This approach allows different types of impact to be considered on a like-for-like basis and in a language that decision-makers readily understand.

Impacts are measured on the following four dimensions:

- Financial – metrics used in project appraisal

- Economic – economic impacts, such as pay, tax and investment

- Social – impacts such as health, education and training

- Environmental - impacts such as greenhouse gas emissions, air pollution and land use.

For those undertaking an ACA, the focus might be on one specific impact category, such as greenhouse gases or on the ‘total impact’ across all four dimensions.

A simplified example of an ACA will focus on the environmental, economic and social impact of a development. More innovative approaches evaluate the interlinked relationship between the four dimensions. For example, upfront investment could in turn preserve and improve social and environmental impacts (see example diagram below).

By contrast, a more traditional development to regulatory standards has more challenges associated with navigating the environmental progress, higher costs from pollution and may have a poorer overall impact on society.

.jpg)

.jpg)

.jpg)