With an ambitious aim of tackling regional inequality, the Levelling Up White Paper (LUWP), published in early February 2022, presents the Government’s vision for regeneration and economic growth. Key to its policy programme will be investment and growth in the Research and Development (R&D) sector.

The LUWP commits to an overall national R&D investment target of £20 billion by 2024-25, while the Government’s Life Science Vision (July 2021) sets out its target for the UK (across government, industry and philanthropy) to invest 2.4 per cent of Gross Domestic Product (GDP) in R&D by 2027.

ALLEVIATING THE BOTTLENECK THROUGH DECENTRALISATION

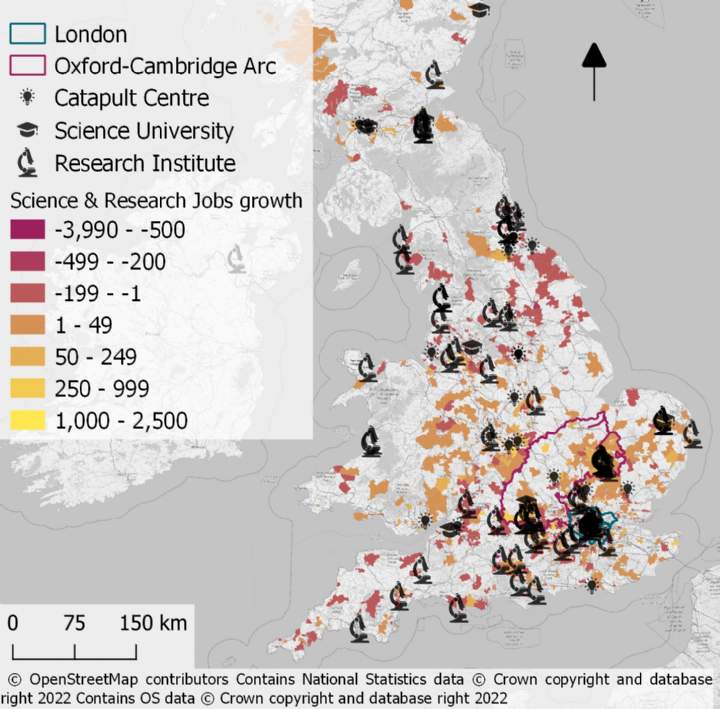

A key plank in the Levelling Up agenda is to 'boost productivity, pay, jobs and living standards' by increasing the R&D spend outside the South East by 40 per cent by 2030, while leveraging 'at least twice as much private sector investment over the long term to stimulate innovation and productivity growth.'

The reason for this is that historically these high productivity jobs have landed in the ‘Golden Triangle’ made up of London, Oxford and Cambridge. Over the last decade approximately 80 per cent of the venture capital raised by life sciences companies was headquartered in London, the South East and the East. The last three years have seen this rise to 86 per cent, driven by Oxford, Cambridge and London. This is significant considering that the UK as a whole has seen capital investment in life science grow from £5.75 billion in 2010 to £16.7 billion in 2020, a rise of 372 per cent.

However, these markets are experiencing severe real estate bottlenecks and constraints. In the middle of 2021, Oxford reported 3.8 per cent lab space availability, while Cambridge reported close to zero per cent lab space availability (with only 30,000 sq.ft available space under offer as of July 2021).

Decentralisation of R&D funding, along with the significant increase in investment in R&D real estate, infrastructure and skills and education, could alleviate these bottlenecks.

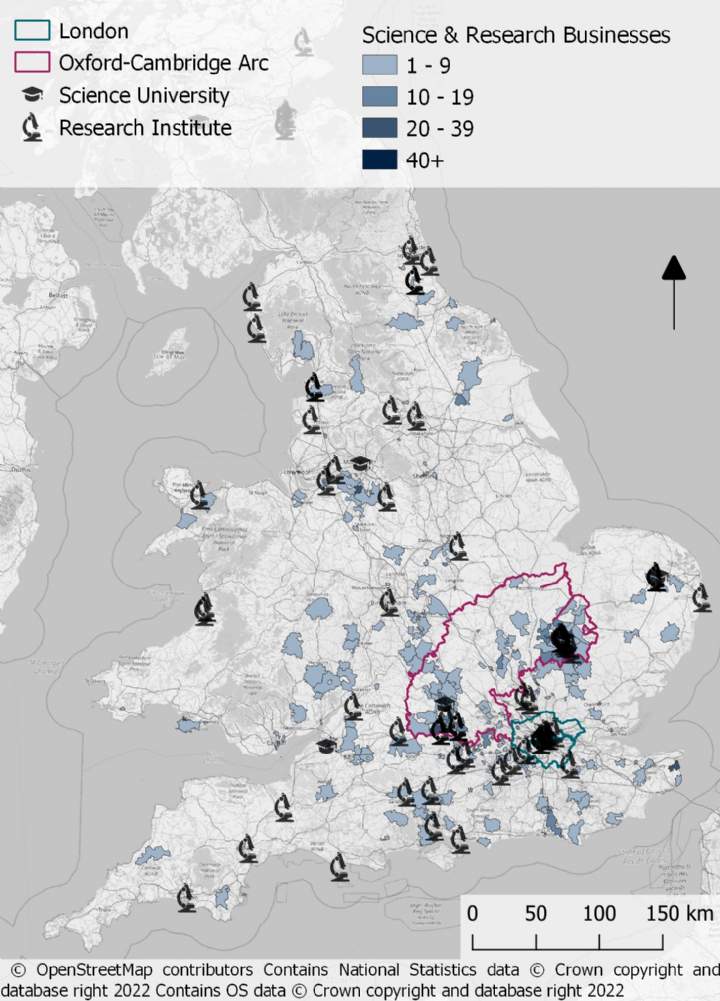

Many top life science research institutions, centres of academic excellence and companies are spread throughout the UK, and are key hooks on which to base this decentralisation strategy.

As noted in the White Paper, 'Levelling Up will only be successful if local actors are empowered to develop solutions that work for their communities'. There are many cities that stand out as credible and strong growth prospects for the life science and wider human health sectors (see map, below). The LUWP proposes to target £100 million of investment in Innovation Accelerator pilots in Greater Manchester, the West Midlands and the Glasgow City Region to foster clusters which leverage private-public-academic partnerships.

Opportunities around key institutional anchors to attract science and research business growth

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)