Following the highest number of property sales for more than a decade last year, the surge in activity in the Guernsey property market continues.

.jpg)

Strong demand for property driven by the pandemic, lifestyle changes and the draw of open space is resulting in a lack of stock in both the sales and lettings markets, in the Local and Open Markets. Keith Enevoldsen, Head of residential sales at Savills Guernsey, answers some questions on the market in 2021 so far:

Who is buying and what type of properties are the most sought-after?

The largest proportion of our recent buyers have been moving to upsize, at 39%, while 16% are downsizing. The remaining buyers are either relocating, investing or purchasing a second home. For this reason, properties with more space, both inside and out, are particularly in demand. Having said that, we are seeing strong activity across the market, from apartments to larger family homes. Looking specifically at the Open Market, which saw the highest volume of sales in almost a decade in 2020, there were 18 sales in the first three months of this year, up from 15 last year. This is despite the second lockdown in February this year, while last year the first lockdown started at the end of the first quarter.

Is now a good time to sell?

The basics of supply and demand suggest now is a good time to sell, since there is upward pressure on prices. We are handling competitive bids on about 40% of sales and in some cases, agreeing sales in excess of guide prices. Some considering selling are nervous, as they are not seeing any properties coming onto the market which they’d like to buy, however due to this strong activity in the market, the portals aren’t giving an accurate representation of what is happening on the ground.

What advice would you give to someone considering selling?

I would recommend instructing an agent with& a good track record and access to an extensive database of contacts such as Savills, particularly at the moment, where many sales are being agreed before a property comes onto the market publicly. Around a third of our recent sales have been to buyers who were already on the Savills database and we are continuing to register new applicants all the time.

And for potential buyers?

My advice would be to have funding in place, or at the very least an agreed sale in a short and stable chain. Once that is the case, register with the agents most likely to handle the sort of property you would like to buy and keep in touch with them. Be proactive, don’t feel you have to wait for them to call you.

Looking at the rental market, what type of properties are most in demand?

The properties in highest demand at the moment are either family homes with three/ four bedrooms which may consider pets, or one bedroom apartments to suit a professional couple working in central St Peter Port. There is high demand across the board for rental properties with many applicants on our database waiting for their perfect home to become available.

What advice would you give to someone

considering letting their property?

Whether you are temporarily relocating for work, or your personal circumstances have changed, letting your home is a great way of moving without selling, and potentially earning additional income in the process. Ask yourself how long are you likely to let your home for? What are all the current costs of running your home? What items do you plan to take and what are you happy to leave for tenants? Have you got any electrical or gas safety records? Do you have any information on how the heating works and manuals for appliances? Are there any guarantees on the property an agent should be aware of? Taking this information into consideration, a lettings agent should then organise a visit to establish if any work is required to let the property legally, discuss the current market and achievable rent, and advise you on your responsibilities as a landlord and your tenant’s rights.

Do you have any advice for tenants searching for a new home?

Keeping in touch with agents is key in the current market. Please ensure that you have been in contact with our friendly team to register your details – as with the sales market, many properties are being let very quickly.

Q1 market overview

The Guernsey Residential Property Prices bulletin, which measures average price changes in residential properties sold on the island each quarter, recently published its headline analysis of trends in average purchase prices.

In its Q1 analysis for 2021, the mix adjusted average purchase price - a measure of the value of sales - for Local Market properties is 3.4% higher than the previous quarter and 14.8% higher than 12 months ago at £509,906. A rise was also seen, using the same metric, in the lettings market with the average rental price increasing by 8.9% and 9.9% compared to Q4 2020 and Q1 2020, respectively. The mix adjusted rental average rental price for Local Market properties in the first quarter of this year was £1,498.

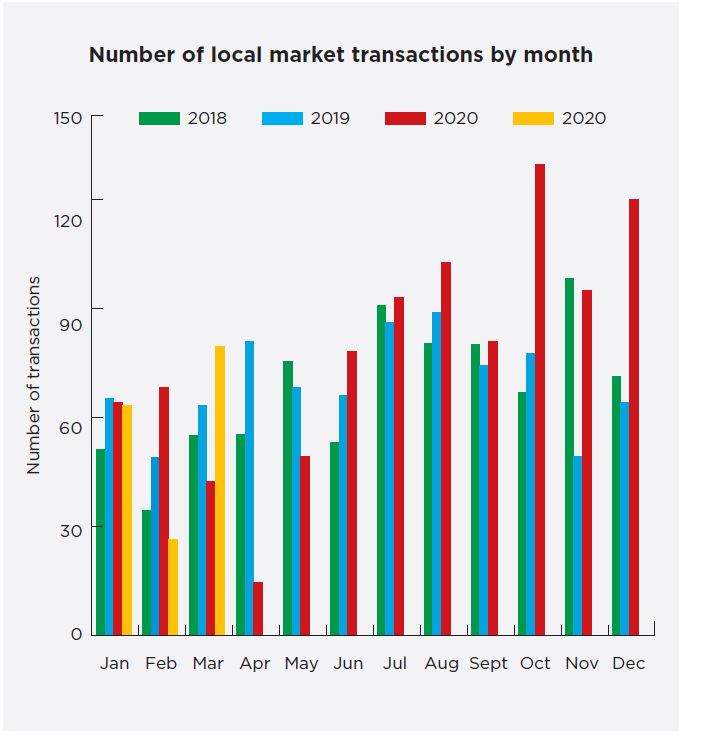

According to the latest bulletin there were 178 fewer Local Market transactions compared to the previous quarter - a direct result of restrictions imposed to slow the spread of coronavirus. However 79 sales was the highest figure in March for a decade.

Source: States of Guernsey

"The lending market is currently busy and in 2020 Lloyds ended the year having lent the most in respect of residential property purchases and this continues to be the case currently in 2021. We have seen further positive news with HSBC reintroducing a 95% loan to value mortgage which the market is certainly requiring. The property market is suffering from a lack of stock for both rental and sales with unprecedented levels of sealed bids for properties being marketed for sale. Somewhat pleasingly all mortgage lenders remain keen to gain market share. Private Banks also continue to play a leading role on assisting High Net Worth individuals as they offer a bespoke product."

Pierre Blampled, SPF

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(2).jpg)

.jpg)