Given the ongoing Covid-19 pandemic, the UK real estate investment market remains challenging. However, based on Savills most recent survey of over 100 clients in late April 2020, investor sentiment in the business space market (industrial, logistics and offices) remains positive.

While the largest proportion of respondents – over 40 per cent – believe they won’t be fully back in the office until Q4 2020, there are indicators suggesting that the scale of the negative impact on the investment market will be reasonably limited.

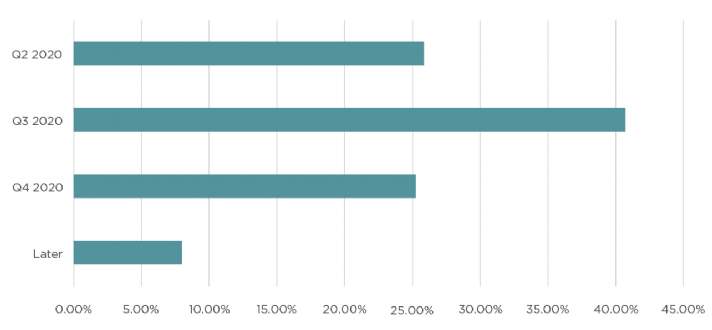

This is supported by 26 per cent of respondents thinking that they’ll purchase their next investment in Q2 2020, with 41 per cent suggesting they’ll continue with their acquisition strategy in Q3 2020.

This is already partly reflected in recent transactions. Between 16 March and 30 April, we recorded a total of around £360 million of either exchanged or completed industrial and logistic transactions, including a number of distribution warehouses, two secondary portfolios and both large and small multi-let estates.

Similarly the office sector has seen approximately £408 million of transactions exchange or complete across the country over the same period, without taking any figures for London into account.

It goes without saying that the practicalities of undertaking due diligence have complicated the investment transaction process somewhat and have delayed those that are under offer. Additionally, many sales which had been scheduled to be launched are on pause until investor inspections, surveys and valuations can take place.

While our survey demonstrates that the majority of investors said they needed some form of discounting to February pricing to gain internal approval to acquire a property in today’s market. However, with the exception of a handful of sale and leaseback opportunities, very few new sales have been launched at a discounted price.

From the survey, it’s evident that private equity firms and UK funds appear to need the least amount of discount to pursue an acquisition: 50 per cent of investors at private equity firms and 48 per cent at UK/fund institutions suggesting they only require a 1-10 per cent discount.

We understand that a readjustment of pricing to reflect a perceived increase in market risk needs to be factored in if a sale has to be concluded quickly. However, we don’t envisage the shift to be as dramatic as in the Global Financial Crisis when bank-led distress precipitated a significant sell-off in commercial property.

This is primarily down to the fact that the level of indebtedness across the sector is significantly lower than in 2006/7 and helped by many of the institutions taking the decision to gate their funds, thereby limiting pressure from redemptions.

On the whole business space investment looks set to remain a relatively safe option, particularly in light of the challenges faced by other sectors (including alternative assets).

Positively, 95 per cent of survey respondents say they have capital to invest in industrial, logistics and offices. This highlights that the market remains a sector of choice for many and that larger swathes of capital are available to be deployed once the lockdown eases further and more opportunities present themselves.

Investor sentiment in the business space market

Q. What discount to February pricing would you anticipate requiring to gain internal approvals to acquire?

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)