If you want to get a handle on the scale of the housing market and its importance to the economy both as an asset class and store of private wealth, then there’s nothing like looking at a number with an awful lot of noughts.

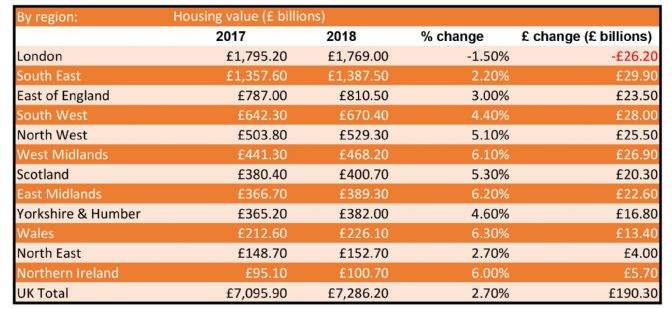

Our latest analysis puts the total value of all homes in the UK at a record £7.29 trillion – or £7,286,200,000,000, to be exact – after a rise of £190 billion in 2018. To put that into perspective and demonstrate why the market impacts consumer sentiment to the extent it does, this equates to 3.6 times UK GDP in the 12 months to September 2018 (£2.03 trillion). And despite growing by just 2.7 per cent amid Brexit fears, gains from housing are ahead of the £187 billion collected by HMRC in income tax in the 12 months to last November.

The regions outside London take centre stage in this scenario, reversing a 10-year trend. Wales showed the biggest gains in percentage terms, up 6.3 per cent and adding £13.4 billion to total £226.1 billion. The East Midlands (6.2 per cent) and West Midlands (6.1 per cent) followed close behind. The value of stock in the South East grew the fastest in absolute terms, with £29.9 billion added on the back of growth of just 2.2 per cent. By contrast, London’s residential stock recorded a 1.5 per cent fall, the first since 2009, in the face of stretched affordability and broader economic uncertainty.

That said, London still accounts for almost a quarter of UK housing value, compared with a fifth a decade ago. At £1.77 trillion, it is more than four times the combined value of Birmingham, Manchester, Edinburgh, Glasgow, Cardiff, Bristol, Liverpool and Sheffield – all cities which saw higher rates of price growth than the capital last year.

Across the UK as a whole, 72 per cent of gains came from price appreciation, equivalent to £4,800 per home, the rest came from new housing development which made its greatest contribution ever. Meanwhile, the increasingly cash-dominated private rented sector saw its value rise faster than all other tenures, up 4.1 per cent to pass the £1.5 trillion mark for the first time.

Once again, we see housing wealth concentrated in ever fewer, older hands. The UK’s over 50s hold more than three-quarters of all UK homeowner equity, while the over 65s in London and the South of England alone account for over a quarter of the total.

At the same time, as affordability becomes more stretched, younger households are having to put off buying their first home until later in life. Those under 35 own just £0.19 trillion (4.9 per cent) of homeowner equity.

It’s great that we’re seeing more housing delivery, but development will have to make up a much higher proportion of new housing value if we are to come anywhere near building the homes this country needs.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)