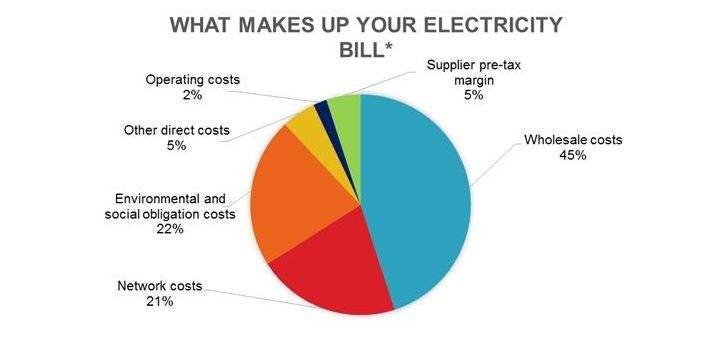

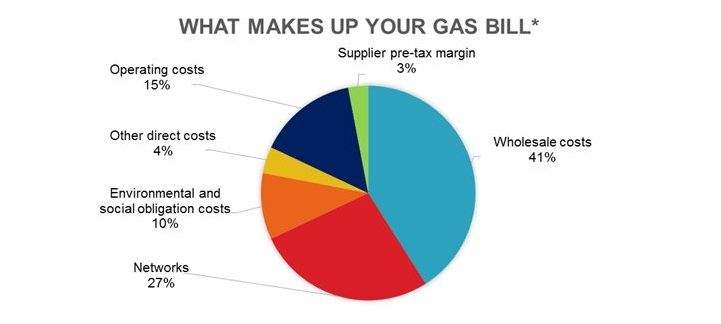

Last year wholesale electric and gas prices increased in volatility leading to a higher than usual unit rate and in turn higher monthly bills for those who have recently renewed their supply contracts. However, this is just the tip of the iceberg. The true, 'unseen' causes for rising bills are what are known as third party costs (TPC) or non-commodity costs and these charges make up most of an energy bill.

What are Third Party Costs?

So what do we mean by third party costs? Utility bills are a blend of the commodity cost (the fuel you consume) and non-commodity costs which include government originated charges and third party charges.

Some of these charges are levied on suppliers who pass them onto the customer. Most energy contracts have these charges included in the overall agreed energy price, meaning they won’t show up on a bill. In some cases they will be named separately but it is down to the supplier whether they do this.

Unless a consumer has an understanding of the energy market, it is very difficult to truly understand what is being paid for. Below is how utility bills are made up:

.png)

.jpg)

.jpg)

.jpg)