The residential portfolio on rural estates is an important source of income – on average across England and Scotland it contributes around 40 per cent of gross income. Indeed the proportion of income generated from this asset has increased significantly over the past 10 to 15 years. On any rural estate non-agricultural income helps to mitigate the financial exposure and the current changes in farming.

Despite cost control being a necessary objective, one temptation may be to cut back on property repairs which currently stand at 23 per cent of average gross income. However, history has shown that such an approach will only serve to create a legacy of lack of repair which will impact on future performance.

We have looked at the relationship between market rents (assured shorthold in England and short assured/private residential tenancies in Scotland) and the repairs of these properties. These properties represent around 60 per cent of all houses on estates in England and Scotland respectively. The results of our analysis show that there is a weak correlation between rents and repairs on houses let at market rents over the past 10 years. Interestingly, the correlation is stronger on estates with a high residential density (greater than 20 houses per 1,000 acres) suggesting that the larger quantum benefits from more management time.

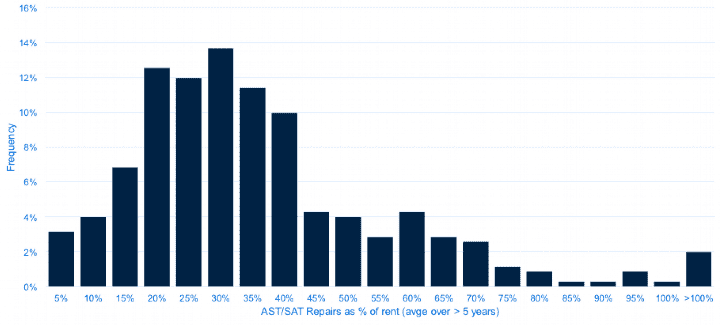

The graph below shows that the majority (80 per cent) of estates are spending up to 50 per cent of annual rental income on property repairs but the remaining 20 per cent are spending significantly more.

.jpg)

.jpg)

.jpg)

.jpg)