London’s future first time buyers

It’s no secret that getting on to the London property ladder is a challenge. However, whilst the number of first time buyer (FTB) mortgages issued in London has fallen by -11% in the year to September 2023, according to UK Finance, this number is still slightly higher than pre-pandemic levels. This suggests that even with high interest rates and the end of the Help to Buy scheme, there is still a desire amongst FTBs to move.

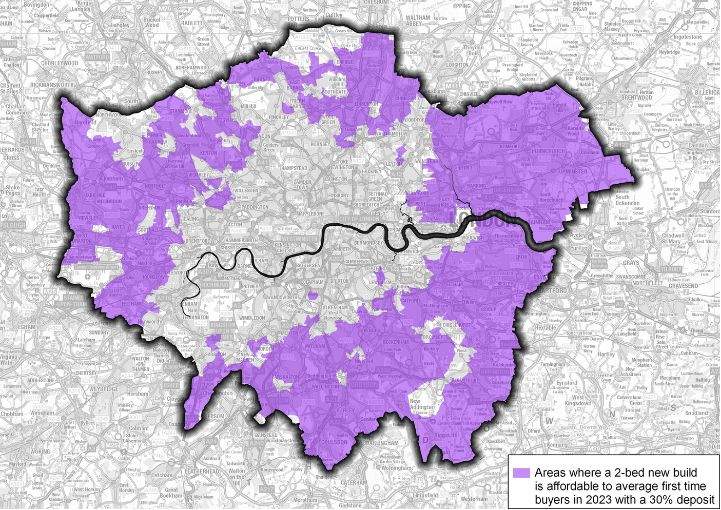

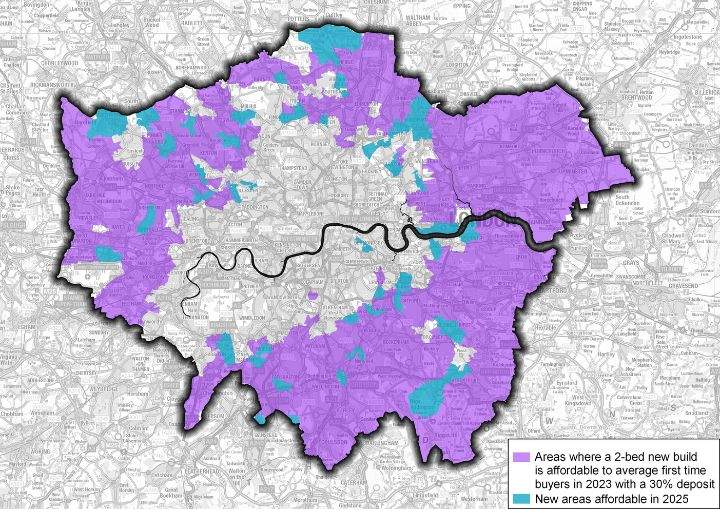

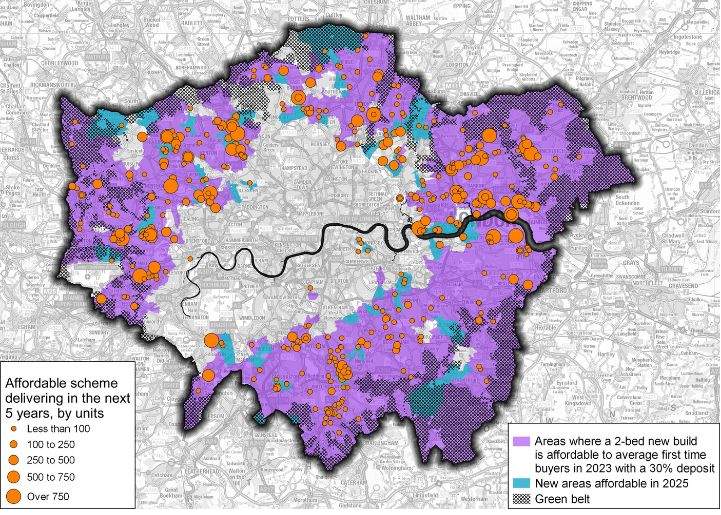

Despite this keenness, FTBs do seem to be struggling to access the new build market. Savills dealbook data shows that FTBs now make up only 27% of the new build market in London down from 45% in 2021. Key issues behind this are likely related to the location, price point, and product type of homes currently being marketed, as well as the loss of the significant helping hand that was Help to Buy. But a detailed understanding of the profile of FTBs and what they are looking for can help those developers seeking to position themselves for the market recovery from 2024 onwards.

.jpg)